There are numerous factors that influence your ability to obtain a loan. One of the important factors is your credit score, as well as the information on your credit report, which will determine whether you can get a loan and what interest rate you will pay. Borrowers should know the importance of credit scores if they are attempting to buy a home, take out a loan for it, or try for a start-up, a business or make a major purchase. Continue reading the blog to understand why a credit score is important.

What is a Credit Score?

A credit score is a three-digit number that lenders check to understand your creditworthiness. It helps them to decide whether you get a mortgage, a credit card, etc. and the interest rate you are charged for this credit. The score is a representation of you as a credit risk to the lender at the time of your loan application. Every person has their own credit score. The lower your credit score is, the less likely you will be to get loans from lenders. If you are approved, you will have the burden of high interest rates.

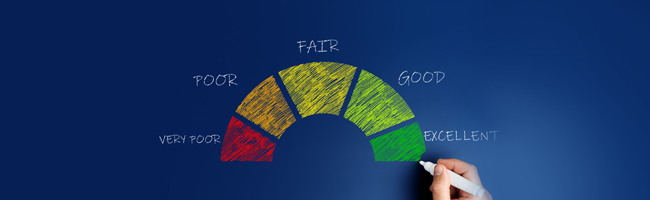

Credit scores range from 300 to 900 and a credit score of 750 and above is considered good.

Many factors influence credit scores, either positively or negatively, as discussed below:

Factors that have a positive impact on credit scores:

- Making credit card payments on time

- Making timely loan payments

- Paying the entire outstanding balance rather than just the minimum due

Factors that have a negative impact on credit scores:

- Late or non-payment of credit card bills and loan EMIs

- Credit card maxing out or consistently exceeding 75% of the credit limit

- Paying only the minimum amount owed on credit cards; the balance is still considered past due

- Having an excessive number of credit lines, particularly unsecured ones

Why is Credit Score Important?

There are several benefits of having a good credit score. If you have a high credit score (750 and above), you can have:

- Decreased interest rates

- Increased loan amount

- More rapid loan approvals

- Extended repayment terms

Your credit score is as important as your employment history, salary, and other eligibility factors when applying for a loan. Ensure that your score is at least 750. 800 and above is an excellent score.

Also Read: How to Improve Your CIBIL Score Above 800

The applicant's repayment history is one of the criteria for loan approval. How do they discover it? By looking at your credit score. A good repayment history equals a high credit score.

A loan with no or low credit is possible, but expect a longer processing time because banks will perform additional checks. Furthermore, you may not always get the best deal.

To make sure that your credit history is error-free, review your report before submitting your loan application.

The following five elements go into calculating your credit score:

| COMPONENT | COMPONENT WEIGHT* |

|---|---|

| Payment history | 35% |

| Amount owed | 30% |

| Length of credit history | 15% |

| Credit mix | 10% |

| New credit | 10% |

*Note that the component weightage is an approximate value based on market study and we do not hold any actual evidence of its accuracy.

Also Read: How is CIBIL Score Calculated?

How Your Credit Score Affects Your Loans?

Banks normally seek a score of 750 when assessing your loan application, which indicates that you have a strong track record of prompt loan repayment and are a low-risk customer. You stand a good chance of getting approved for a loan or credit card if your credit score is 750 or above. Banks, on the other hand, would almost likely reject your loan or credit card application if you have a low credit score and are hesitant to grant you credit.

There are many different types of loans available that you might wish to apply for. Let's examine the effects of the CIBIL credit score on each of these loans in more depth.

1. Credit score impact on the auto loan approval process

An auto loan can be used to purchase a vehicle. It could be a loan for a motorcycle or a loan for the purchase of a car. In addition to your income, several factors influence the amount you must repay. Another advantage is that you can borrow up to 90% of the invoice value of the vehicle. Although there is no minimum credit score requirement, it is recommended that you obtain a car loan if your score is at least 700.

You can still get a loan if you don't have a credit score of 700 or higher. However, the loan's interest rate will be on the high side. As a result, you might end up paying more in the long run.

2. Credit score impact on the approval of a personal loan

Because a personal loan is an unsecured loan, it already has a high-interest rate. There are no restrictions on how the loan can be used. That means you can use the loan to fund your child's education or to take your dream vacation. Because the loan is unsecured, no such collateral is required to hedge the risk. There is no minimum credit score required to apply for a personal loan. Because the bank will only lend you funds if you have a good credit score, the higher your credit score, the better your chances of having your loan application approved.

If your credit score is low, you will be able to obtain a personal loan at exorbitant interest rates.

3. Credit score impact on the Home Loan approval process

You can always apply for a loan to purchase your dream home. It is a mortgage loan. You can also borrow funds against your existing property. A loan of up to 80-85% of the property's cost may be made available. The repayment period ranges from five to thirty years. Many factors influence interest rates, including the city, location, current property rates, and so on.

Along with the previously mentioned factors, your credit score is very important in the Home Loan approval process. If you have a high credit score, banks will assume that you have always been a responsible borrower and that you can repay your debt on time without fail. As a result, the interest rate will be lower.

Lenders consider a credit score of 750 to 900 to be the best for quickly approving your loan application. This range indicates that the borrower used financial restraint when making debt payments. A score of 625 to 750 is considered moderate, indicating that the borrower carries some risk but still has a chance of getting loans approved. Lenders, on the other hand, are hesitant to give loans to people with a score between 300 and 625 because it indicates the borrower is very risky due to the possibility of defaulting on the loan.

Conclusion

Credit scores, ranging from 300 to 900, influence loan approvals. Higher scores signify lower risk and prompt approvals, lower interest rates, and higher borrowing limits. Maintaining a score above 750 is vital for accessing feasible loans across various loan types and achieving financial objectives. With financial planning, you can improve your credit score and get your housing loans.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Content with tag .

Trending Articles

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Does Being A Loan Guarantor Affect Your Credit Score?2023-03-23 | 4 min

cibil Cibil

[N][T][T][N][T]

What is Credit Mix and How to Boost Your Credit Score?2023-03-27 | 7 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2023-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

What Is a Good Credit Score for a Home Loan?2022-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

Things That Can Go Wrong with Your CIBIL Report2023-03-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Your CIBIL Score Help in Negotiating Better Home Loan Deals2023-05-18 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

How Does Missing One Payment Affect Your CIBIL Score?2024-05-15 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Easy Ways to Maintain a Good Business Credit Score2024-01-10 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Raise My Credit Score From 360 to 800 Within a Year?2024-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

Loan Settlement And Its Effects On Your Credit Score2024-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Everything You Need to Know About the Ideal CIBIL Score for Business Loan2024-01-17 | 4 min

cibil Cibil

[N][T][T][N][T]

What is the Role of CIBIL Score in Getting a Home Loan?2024-05-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 6 Proven Methods2024-01-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How is CIBIL Score Calculated - Factors That Affect CIBIL Score Calculations2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02023-08-23 | 3 min

cibil Cibil

[N][T][T][N][T]

CIBIL Score Charges & Services You Must Know2023-04-04 | 2 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Get a Good Credit Mix and Boost Your Credit Score2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is CIBIL Score Important for Your Financial Health?2023-04-17 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL Score and How is it Impacted by a Missed EMI?2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

The Role of CIBIL Score in Determining your Home Loan Disbursement Amount2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002023-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Scoring Models You Must Know2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Ways to Maintain a Healthy Credit Score and Profile2023-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Does Applying for Credit Affects One's CIBIL Score?2023-03-15 | 3 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score for Achieving Business Goals2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Reveal About You?2023-04-05 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Tips to Help You Improve Your CIBIL Score2022-12-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Effective Strategies for Boosting Your Credit Rating2023-03-24 | 6 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Why is Credit Score Important After Retirement?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Easy Tips On How Chartered Accountants Can Increase Their CIBIL Score?2023-01-23 | 4 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2023-09-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Some of the Common Credit Mistakes to Avoid2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?