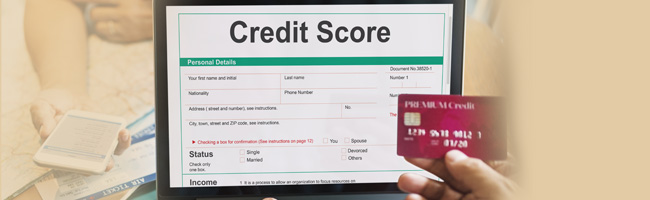

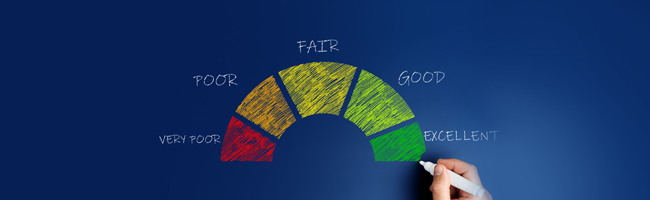

An individual’s credit report and credit score indicate their creditworthiness, and lenders assess these two vital pieces of information to analyse the risk involved for them in lending money to the borrower. A credit score is a numerical representation of a credit’s attitude towards credit. It is a three-digit number between 300 and 900 that indicates a potential borrower’s financial well-being as well as their chances of repaying a loan on time.

The credit report is a detailed document that tells lenders about a potential borrower’s current and existing debt or loan accounts, how they have handled debt so far, their payment history, etc. The importance of credit reports in ensuring quick loan approval and fetching one the best terms and conditions on a loan cannot be denied. If you are planning to avail of a loan, you must check your credit report at least six months before beginning the loan application process so that you can take corrective measures, if need be.

Here’s Why You Must Check Your Credit Report Regularly

Now that we have established the importance of credit reports in the loan process, let us look at why you must check your credit report regularly.

You Can Spot Errors and Get Them Rectified in Time

Credit information bureaus use the information availed of from various lenders to create a borrower’s credit report. Sometimes, lenders pass on wrong information and this leads to errors creeping in your credit report. If the misinformation is identity-related, lenders will have a difficult time getting access to your credit report. On the other hand, if the error is related to your spending habits or payment history, your credit score will take a toll. If your credit score goes below 750, you will find it difficult to get approved for a loan. You must check your credit report from time to time and immediately report any errors. Rectifying these errors and for the changes to reflect in your credit score can take a few months. So, you must check your credit report often and report errors as soon as possible.

People Also Read: How to Check, Calculate, and Improve CIBIL Score?

You Can Take Corrective Measures on Time

You must check your credit report regularly and if you realize that your credit score is below 750, you must take corrective measures immediately. To improve your CIBIL score, pay all EMIs and credit card bills on time, reduce your credit utilization ratio, clear small debts and limit applications for new loans. Please keep in mind that it takes time to improve your CIBIL score. Be ready to be patient; it will take at least six months for all these corrective measures to reflect in your account. Borrowers must check their credit report often so that they can start taking corrective measures immediately, if need be. It is also important to check your credit report regularly to understand how a missed or delayed EMI payment affects your credit rating.

It Helps Reduce Chances of Identity Theft

A report published in 2015 stated that in 2014, 1042 million fell prey to identity theft. What is identity theft in the credit world, you ask. When fraudsters steal a borrower’s personal information and avail of credit on their name, it is known as identity theft. By checking your credit report regularly and analysing it for suspicious entries, you can reduce chances of loan theft. Check your report from time to time, check each entry and make sure there are unauthorised transactions under your name.

So, how often should one check their credit report? In our next section, we answer this question that many borrowers have.

How Often Should You Check Your Credit Score?

When a lender enquires about a borrower’s credit score, it is known as a hard enquiry. Too many hard enquiries negatively impact a borrower’s credit rating. On the other hand, when a borrower checks their credit score or asks for their credit report, it is known as a soft enquiry. Soft enquiries do not impact a borrower’s credit rating. Borrowers often get confused between soft enquiries and hard enquiries and therefore, do not check their credit score often. So, let us clear this misconception once again – soft enquiries do not impact a borrower’s credit rating. So, how often can I check my credit report, you ask. Borrowers can check their credit score as many times as they like. Ideally, they should check their credit score at least once every year. If they plan to avail of a loan, they must check their credit score every six months.

Also Read: Ways to Check Your CIBIL Score Online

How to Check Your Credit Report

While there are websites that perform CIBIL score check free, these websites cannot be entirely trusted for accuracy. Therefore, it is advised that borrowers should check their credit score on the official website of CIBIL.

To check your CIBIL score with an Aadhar Card or PAN card, simply follow these steps:

- Go to the official website of TransUnion CIBIL and select the option ‘Get Your CIBIL Score’.

- To be able to see your CIBIL score on TransUnion CIBIL, you will have to pay a fee. If you want to check your credit report regularly, select a subscription plan.

- Provide basic details, such as your date of birth, email address, phone number, etc. You will also need to create a password for your account.

- If you are checking your credit report by PAN Card, enter your PAN details. Otherwise, enter your Aadhar details.

- Verify your identity by answering all the questions.

- Enter your account by paying a small fee based on the plan you have chosen.

- Login to your account and fill out the CIBIL score display form.

- TransUnion CIBIL will tell you your credit score and send you a detailed credit report in your account.

People Also Read: How to Check Your CIBIL Score for Free in India

Final Words

Your credit report and credit history play a crucial role in determining whether you will be approved for a loan as well as the terms and conditions, including the rate of interest, you will get on your loan. If your credit score is 750 or above, availing of credit will be easy. On the other hand, if your credit score is below 750, lenders will certainly second guess their decision to give you credit.

Borrowers must check their credit report at least once every year to make sure their credit score is what it should be. If they are planning to apply for a loan, they must check their credit score at least once every six months and take corrective measures in time to ensure quick approval and beneficial loan terms and conditions.

Also Read: Check CIBIL Score with PAN Card for Free, in 3 Steps

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Content with tag .

Trending Articles

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Does Being A Loan Guarantor Affect Your Credit Score?2023-03-23 | 4 min

cibil Cibil

[N][T][T][N][T]

What is Credit Mix and How to Boost Your Credit Score?2023-03-27 | 7 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2023-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

What Is a Good Credit Score for a Home Loan?2022-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

Things That Can Go Wrong with Your CIBIL Report2023-03-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Your CIBIL Score Help in Negotiating Better Home Loan Deals2023-05-18 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

How Does Missing One Payment Affect Your CIBIL Score?2024-05-15 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Easy Ways to Maintain a Good Business Credit Score2024-01-10 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Raise My Credit Score From 360 to 800 Within a Year?2024-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

Loan Settlement And Its Effects On Your Credit Score2024-03-07 | 6 min

cibil Cibil

[N][T][T][N][T]

Everything You Need to Know About the Ideal CIBIL Score for Business Loan2024-01-17 | 4 min

cibil Cibil

[N][T][T][N][T]

What is the Role of CIBIL Score in Getting a Home Loan?2024-05-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact Of a Co-Applicant’s CIBIL Score On Your Home Loan Application2023-01-20 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 6 Proven Methods2024-01-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How is CIBIL Score Calculated - Factors That Affect CIBIL Score Calculations2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Report Errors and How to Fix Them_WC2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02023-08-23 | 3 min

cibil Cibil

[N][T][T][N][T]

CIBIL Score Charges & Services You Must Know2023-04-04 | 2 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Mix and How Can It Help Your Credit Score?2023-07-12 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Get a Good Credit Mix and Boost Your Credit Score2023-07-11 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is CIBIL Score Important for Your Financial Health?2023-04-17 | 3 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL Score and How is it Impacted by a Missed EMI?2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

The Role of CIBIL Score in Determining your Home Loan Disbursement Amount2023-05-31 | 2 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002023-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Is a Good CIBIL Score Mandatory for Home Loan Approval?2023-02-17 | 4 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score & Tips To Improve It2023-02-21 | 5 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Different Types of Credit Scoring Models You Must Know2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

Ways to Maintain a Healthy Credit Score and Profile2023-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

Top Tips to Improve Credit Score Immediately to Get Your Loan Approved2023-03-30 | 5 min

cibil Cibil

[N][T][T][N][T]

Reasons to Maintain a Positive Credit Profile and a High CIBIL Score2023-03-01 | 5 min

cibil Cibil

[N][T][T][N][T]

Does Applying for Credit Affects One's CIBIL Score?2023-03-15 | 3 min

cibil Cibil

[N][T][T][N][T]

Importance of CIBIL Score for Achieving Business Goals2023-03-16 | 5 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Reveal About You?2023-04-05 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Tips to Help You Improve Your CIBIL Score2022-12-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Effective Strategies for Boosting Your Credit Rating2023-03-24 | 6 min

cibil Cibil

[N][T][T][N][T]

Why is Credit Score Important After Retirement?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

5 Ways to Increase CIBIL Score After Job Loss2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

7 Easy Tips On How Chartered Accountants Can Increase Their CIBIL Score?2023-01-23 | 4 min

cibil Cibil

[N][T][T][N][T]

High CIBIL Score Helps Low-Interest Rate Loans2023-09-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Some of the Common Credit Mistakes to Avoid2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?