Buying a plot of land and building your home on it is an exciting prospect, as it comes with flexibility. However, financing it requires a structured loan that addresses both the land purchase and the cost of construction. This is where a composite Home Loan can be a convenient option for you.

If you are looking to understand what a composite loan for homes involves, how it differs from traditional Home Loans, and whether it is the right option for your needs, this guide covers everything you need to know.

What Is a Composite Home Loan?

A composite Home Loan is a type of housing finance designed for individuals who want to purchase a plot and construct a house on it, but not necessarily at the same time. Unlike a standard Home Loan that finances the purchase of a ready-built or under-construction property, a composite loan combines two purposes into one: it funds both the purchase of the plot and the construction of the house.

The key distinction here is that the construction does not have to start immediately. Most lenders allow a grace period within which the borrower is expected to begin construction. This makes a composite loan a practical choice for those who have long-term plans but want to secure land first.

Key Features: How a Composite Home Loan Works

A composite Home Loan comes with distinct characteristics that set it apart from regular Home Loans:

-

Dual Funding Purpose

This loan is specifically structured to finance the purchase of a residential plot and the construction on it. Both components are funded under a single loan product.

-

Staged Disbursement

Lenders typically disburse the loan amount in phases. The first disbursement is made toward the plot purchase, while the rest is disbursed in tranches based on the construction progress.

-

Time-Linked Conditions

Borrowers are usually required to begin construction within a stipulated period from the date of loan disbursal for the plot. If construction is not initiated within this timeframe, the loan may be reclassified or penalised, depending on the lender's policy.

-

Interest Structure

Interest is charged only on the amount disbursed. During the plot purchase stage, EMIs are calculated on the initial disbursed amount. As construction progresses and additional funds are released, the EMI is revised accordingly.

Composite Home Loan vs. Traditional Home Loan

Here is how a composite Home Loan differs from a traditional Home Loan:

| Feature | Composite Home Loan | Traditional Home Loan |

|---|---|---|

| Purpose | Purchase of land and construction | Purchase of ready-to-move or under-construction homes |

| Disbursement | In stages: land first, then construction | Lump sum or based on the builder project stages |

| Timeframe to Start Construction | Usually within 18–24 months of plot purchase | Not applicable |

| Loan Structure | Combined into one loan with a single agreement | Single-purpose (property purchase only) |

| Documentation | Plot and construction-related documents | Builder agreement, property papers |

Benefits of a Composite Home Loan

Opting for a composite Home Loan can offer multiple benefits:

-

Consolidated Financing

Instead of applying separately for a plot loan and a construction loan, borrowers can manage both components under one structured loan.

-

Cost-Effective

By combining land and construction under a single loan, borrowers may access better home loan interest rates and lower processing fees compared to taking two different loans.

-

Flexibility to Plan

This loan gives borrowers time to plan their home construction while still securing the plot, especially useful for those not planning to build immediately.

Tips for Choosing the Right Composite Home Loan

Before applying for a composite Home Loan, consider the following tips to make an informed decision:

-

Compare Lenders

Check interest rates, processing charges, and construction timeline conditions across lenders to find a loan that best matches your requirements.

-

Understand the Construction Timeline

Be clear about the time limit provided by the lender to begin construction. This affects disbursement and compliance conditions.

-

Plan Construction Budget

Work with a qualified architect or contractor to get realistic cost estimates. This will help in borrowing an adequate amount and avoiding cash flow issues later.

-

Check Disbursement Conditions

Understand how and when the funds will be released during construction. Some lenders require inspections or documentation at each stage.

-

Clarity on Repayment Structure

As disbursement happens in phases, the EMI amount will increase over time. Check how the lender structures this and prepare your budget accordingly.

A composite Home Loan is a suitable choice for homebuyers looking to purchase a plot and build their dream home at their own pace. By combining the cost of the land and construction under a single loan, borrowers enjoy convenience, better control over their home-building journey, and potential savings on overall borrowing costs.

Understanding the structure and timelines involved is essential. Whether it is evaluating a composite Home Loan vs. a traditional Home Loan, assessing your eligibility, or planning your construction budget, taking a well-informed approach ensures a smoother experience. At Bajaj Housing Finance, we currently offer Home Loans specifically for the purchase of ready or under-construction properties.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

How to Generate a CIBIL Score for the First Time and Build a Strong Credit Foundation2026-01-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Without Credit Score – How to Apply Even with No Credit History2026-02-26 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Co-Applicant in a Home Loan – Eligibility, Rules, and Documents Explained2026-02-26 | 5 min

home+loan Home Loan

[N][T][T][N][T]

DDA Housing Scheme Delhi – Everything You Need to Know About the Schemes2025-10-17 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Delhi Property Registration Guide: Understanding Registration, Charges and Circle Rates2025-11-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Impact of Home Loan Foreclosure on Credit Score – Should You Close Your Loan Early2025-07-24 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Assam Land Records: A Guide to Dharitree Portal, Land Patta Types, and Online Registration2025-02-17 | 4 min

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?2023-06-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Detailed Overview of ‘A Khata’, ‘B Khata’ Certificates: Meaning, Differences, & Conversion Process2025-02-17 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL MSME Rank Explained – Why It Matters for Your Loan Against Property Application2025-07-07 | 5 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2024-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the ECN Number in Your CIBIL Report2025-07-08 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02024-06-20 | 3 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002024-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Get Commercial CIBIL Report – A Guide for LAP Applicants2025-07-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

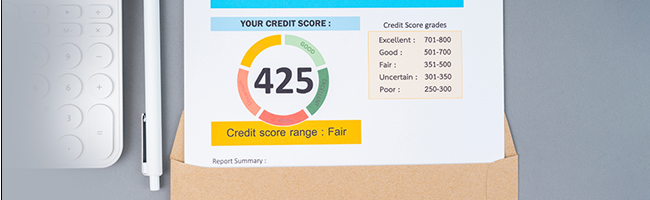

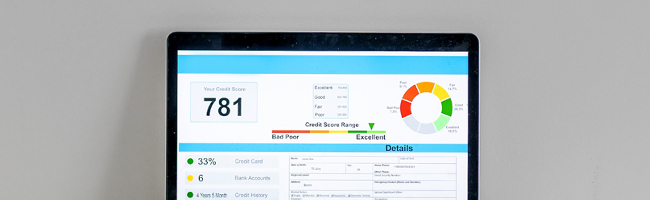

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How a ‘Settled’ Status Can Affect Your CIBIL Score and Your Home Loan Chances2025-07-03 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score Rules – What Every Home‐Loan Applicant Should Know2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Improve Your CIBIL Score for a Home Loan in India?2025-09-19 | 3 min

[N][T][T][N][T]

How to Download Your CIBIL Report Online for Free?2025-11-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Exploring the Impact of Credit Applications on Your CIBIL Score2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

[N][T][T][N][T]

DLC Rate Rajasthan – What You Need to Know2025-09-29 | 4 min

[N][T][T][N][T]

Home Loan Eligibility for Informal Income Profiles2026-02-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

[N][T][T][N][T]

Sambhav Home Loan for Street Vendors and Hawkers2026-02-23 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

[N][T][T][N][T]

Sambhav Home Loans for Small Shop Owners2026-02-23 | 6 min

[N][T][T][N][T]

Sambhav Home Loans for Small Business Owners2026-02-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

[N][T][T][N][T]

How RERA Is Reshaping Trust in Affordable Housing?2026-02-20 | 3 min

[N][T][T][N][T]

Affordable Housing as a Structured Growth Driver2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Assam2025-11-12 | 3 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

tax Tax

[N][T][T][N][T]

How to Avail of Tax Benefits on a Loan Against Property2024-06-13 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

tax Tax

[N][T][T][N][T]

How to Claim Home Loan Tax Exemptions and HRA Together2023-03-22 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

tax Tax

[N][T][T][N][T]

Can I Claim Home Loan Tax Benefits on an Under-Construction Property?2024-05-23 | 5 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

tax Tax

[N][T][T][N][T]

8 Different Ways to Avail of Tax Benefits on Home Loans2023-03-03 | 4 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

[N][T][T][N][T]

PMC Property Tax: How to Pay Online2025-11-06 | 3 min

[N][T][T][N][T]

How to Calculate and Pay KMC Property Tax Online in Kolkata2025-11-06 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

[N][T][T][N][T]

Jantri Rate Gujarat – A Complete Guide to Land Valuation