When individuals apply for a Home Loan, the first thing that a lender does is check their CIBIL score to gauge their repayment capacity. The CIBIL score is a three-digit number ranging between 300 and 900 that denotes an individual's creditworthiness and repayment capacity.

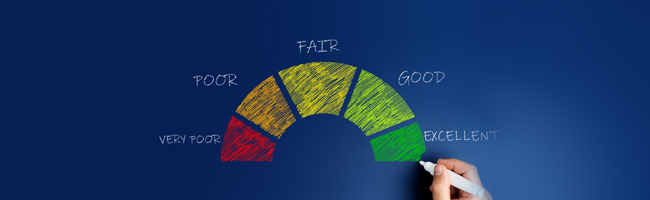

An individual's CIBIL score is calculated based on several factors, such as the individual's current income and debt ratio, past repayment behaviour, and the responsibility with which they use credit. So, what is the ideal score one should maintain to be able to borrow a Home Loan or any other loan at favourable terms? Potential borrowers should maintain a credit score of 750 and above to be eligible for a loan.

A CIBIL score is one of the key factors that decide whether a lender will sanction or approve a business loan for a company. In this article, we discuss everything about CIBIL scores for business loans.

What is a Company Credit Score?

Like individuals have a credit score, companies also have a credit score called the company CIBIL score. The company CIBIL score indicates a company's creditworthiness and is calculated based on various parameters, such as a company's financial health, payment history, and existing debt. Lenders obtain this score from the company's credit report, which contains other information as well.

A company's credit report gives background details about a company, such as the name of the parent company, year of establishment, and existing subsidiaries. The company credit report also mentions the company's CIBIL score. Depending on your preferred credit agency, your company's CIBIL score will vary between 300 and 900. Borrowers should know that if their lender obtains their company's credit report from TransUnion, the credit rating will vary between 1 and 10, with 1 being the highest credit rating a company can get. However, if a lender chooses to go with CRIF High Mark India, the company credit rating will vary between 300 and 900, with 900 being the highest score a company can get.

Also Read: Everything You Should Know About Your CIBIL Score

Now that we know what a company's CIBIL score is, let us look at the importance of this score and understand why lenders check this score before deciding on any business loan application.

How is CIBIL Score Important for a Business Loan?

Before we can answer this question, let us look at the factors that affect a company's credit score. Developing an understanding of these factors will also allow us to understand why the CIBIL score is important for business loans.

The company CIBIL score or the company credit report (CCR) is indicative of a company's financial health and repayment capacity. Lenders assess a company's financial health based on its current income, current sales, existing debt, etc. The CCR allows a lender to understand whether the company will be able to repay the loan that it wishes to avail of and if lending funds to the company would involve risk.

When it comes to businesses, a company's assets including land, factory stores, machinery, vehicles, etc., play a key role in deciding if a company should be sanctioned credit. Having a high number of assets increases one's chances of obtaining credit on favourable terms. The company CIBIL score also tells lenders about the assets that a company has.

The CCR also discloses various financial ratios of a company, such as gross profit margin, return on sales, liquidity, and leverage inventory. These financial ratios also help lenders assess a company's financial health and ability to repay the loan.

A company's CIBIL ratio also depicts its payment history. You may have availed of multiple loans when running a business. In such cases, lenders can focus less on the number of loans taken previously and more on the repayment history — specifically, how many loans have been successfully repaid and how many are yet to be repaid. The CIBIL score for business loans is important as it indicates if a company has cleared loans on time and can be trusted with future repayments.

Read Also: Tips to Help You Improve Your CIBIL Score

Lastly, a company's credit report also shows how old or new the company is. Old companies have had the chance to build their repayment history and credit score and can be considered more reliable. Therefore, lenders may sanction loans to old companies more easily than they do to new companies.

In conclusion, the company CIBIL score is important as it provides lenders with comprehensive insights into the company's creditworthiness before approving a loan. The next question now is how to maintain an ideal score for a business loan. Read on to know the answer.

What is the Ideal Score for a Business Loan?

When applying for a business loan, ensure you have a high CIBIL score to avoid rejection and prevent decreases in your credit score, which can affect future loan eligibility.

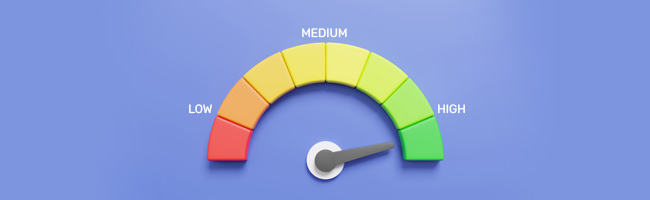

To be able to avail of a business loan, companies should have a credit score of 750 or above. If the company's credit score is between 600 and 750, your company may get approved for a business loan but this loan will be extended on less favourable terms. If your company credit score is under 600, your business loan application will most probably get rejected.

How to Maintain an Ideal Score for Business Loans?

You can maintain an ideal CIBIL score by practising the following:

1. Always Pay All the Bills on Time

When individuals miss EMI payments, their credit rating takes a hit. Similarly, a company's credit rating also decreases when the company misses its EMI deadlines. Missing too many EMI payments leads to a low credit score, which in turn, reduces a company's chances of availing of credit in future. Thus, to maintain a good credit rating, companies should always pay dues on time.

2. Keep Your Credit Utilisation Ratio Low

Yet another easy way to maintain a high credit rating is to keep your credit utilisation ratio on the lower side. A low credit utilisation ratio not only helps in maintaining a healthy credit score but also demonstrates responsible financial management to lenders.

3. Take Loans Only if Necessary

Owing to several expenses, company owners can rely on loans to meet business requirements. However, one should take a loan only when necessary. This will help in maintaining financial health by minimising debt obligations.

4. Take a Small Loan and Pay it Off Diligently

If you need a substantial business loan but your credit score is low, you can try improving the score by availing of a small loan and paying it off responsibly. This will also help you get approved for a loan at favourable terms.

5. Do Not Close Old Loan Accounts

When a business closes a loan account, its entire credit repayment history is deleted. Thus, in the absence of old accounts, a business has no credit history and hence, no credit score or report to show. Therefore, businesses should not close old accounts and company credit cards.

6. Get Errors Rectified Quickly

Sometimes, a company's credit score may decrease because of errors made by other companies and institutions while reporting financial statements. Therefore, companies should check their credit report regularly for errors. If you see any errors, report those to a credit agency immediately. Know that rectification takes some time to reflect on a credit report.

Read Also: Know How Mortgage Loan Affect Your Cibil Score

*Terms and conditions apply.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

loan+against+property Loan Against Property

[N][T][T][N][T]

A Guide to Loan Against Property for Doctors2022-06-27 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

3 Different Loan Against Property Types You Should Know About2024-02-13 | 5 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Property for Doctors: Interest Rates and Charges2023-11-24 | 6 Min

loan+against+property Loan Against Property

[N][T][T][N][T]

Why Loan Against Property Can be a Good Credit Option for a Startup Business?2023-12-22 | 5 Min

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Home Loan and Personal Loan: Which is better?2024-03-04 | 4 min

[N][T][T][N][T]

6 Smart Tips to Increase Your Home Loan Eligibility2024-06-27 | 4 min

[N][T][T][N][T]

5 Essential Things You Need for a Home Loan Approval2024-05-08 | 3 min

[N][T][T][N][T]

7 Benefits of Taking a Home Loan in India2024-06-19 | 3 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

All About Home Loan Balance Transfers2024-06-04 | 4 mins

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

cibil Cibil

[N][T][T][N][T]

How Does Being A Loan Guarantor Affect Your Credit Score?2023-03-23 | 4 min

cibil Cibil

[N][T][T][N][T]

What is Credit Mix and How to Boost Your Credit Score?2023-03-27 | 7 min

cibil Cibil

[N][T][T][N][T]

Will a Loan Settlement Ruin My CIBIL Score?2023-03-21 | 4 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Does CIBIL Score Affect Loan Against Property Eligibility?2023-02-15 | 7 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2023-03-29 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Top-up Loans on a Home Loan2024-04-09 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is a Good Credit Score for a Home Loan?2022-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

Things That Can Go Wrong with Your CIBIL Report2023-03-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Better Interest Rate on Your Home Loan2024-01-04 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can Your CIBIL Score Help in Negotiating Better Home Loan Deals2023-05-18 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Get a Home Loan Without Visiting Branch: A Step-by-Step Guide2024-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-02-16 | 8 min

cibil Cibil

[N][T][T][N][T]

Here’s What You Can Do to Improve Your CIBIL Score2023-03-16 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

tax Tax

[N][T][T][N][T]

How to Avail of Tax Benefits on a Loan Against Property2024-06-13 | 5 Min

cibil Cibil

[N][T][T][N][T]

Top 10 Reasons For Low CIBIL Score & How To Improve It2024-03-01 | 5 min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top Benefits of a Loan Against Property Over Collateral-Free Loans2024-01-09 | 4 min

cibil Cibil

[N][T][T][N][T]

Five Reasons Why a Bad Credit Score Could Lead to Loan Rejection2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Types of Home Loan Charges2024-01-22 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

What is Foreclosing a Home Loan? These are Some of the Do’s and Don’ts2023-12-20 | 6 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

home+loan Home Loan

[N][T][T][N][T]

All You Need to Know About Home Loans2023-01-19 | 5 min

cibil Cibil

[N][T][T][N][T]

Ways You Can Improve your Credit Score for a Small Business2023-03-01 | 5 min

tax Tax

[N][T][T][N][T]

5 Tax Savings and Other Advantages You Can Get When You Apply for Home Loans2024-02-14 | 6 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

[N][T][T][N][T]

Checklist of Documents Required for Home Loan2024-02-07 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Housing Loan Approved Instantly?2024-04-10 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What Is a Pre-Approved Home Loan and How Should You Get It Done?2024-03-12 | 5 min

tax Tax

[N][T][T][N][T]

Should You Get a Home Loan to Save Your Taxes?2024-02-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Short vs. Long Loan Against Property Tenor - Which Is Better?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

tax Tax

[N][T][T][N][T]

What is a Property Tax in India and How is It Calculated?2024-03-13 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding the Fees and Charges on Your Loan Against Property2024-04-10 | 6 min

cibil Cibil

[N][T][T][N][T]

How Does Missing One Payment Affect Your CIBIL Score?2024-05-15 | 4 min

home+loan Home Loan

[N][T][T][N][T]

6 Ways to Reduce Your Home Loan Interest2024-03-20 | 4 min

cibil Cibil

[N][T][T][N][T]

Ways to Improve Your Credit Score with a Credit Card2024-02-02 | 4 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What Affects the Interest Rate on Your Home Loan2024-03-13 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Easy Ways to Pick the Right Loan Against Property Tenor2024-05-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

tax Tax

[N][T][T][N][T]

How to Save Tax for Salary Above 30 Lakh?2023-08-07 | 6 min

tax Tax

[N][T][T][N][T]

How to Save Tax Between Rs 20 to Rs 25L Salary in India2023-07-19 | 6 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Advantages for First-Time Home Buyers2023-07-14 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Determine Your Ideal Credit Score for a Home Loan?2024-03-28 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Would it be Possible for Me to Apply for a Second Mortgage?2024-05-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Easy Ways to Maintain a Good Business Credit Score2024-01-10 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Common Myths About Home Loans: All You Need to Know2024-04-08 | 5 min

[N][T][T][N][T]

5 Benefits of Availing of a Home Loan at an Early Age2024-05-10 | 3 min

[N][T][T][N][T]

7 Smart Ways to Boost Your CIBIL Score for a Home Loan2024-05-09 | 6 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Can I Raise My Credit Score From 360 to 800 Within a Year?2024-03-21 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

tax Tax

[N][T][T][N][T]

Income Tax Structure in New Regime: New Tax Exemption Limit 20232024-05-08 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Top 5 Issues Regarding Loan Against Property Application Rejection that You Might Face2023-02-14 | 5 min

tax Tax

[N][T][T][N][T]

Know all About Top Up Loans and How to Avail of Tax Benefits2023-12-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

5 Tips for Lowering Home Loan Interest Rates in 20232024-03-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How Can Your Credit Score Impact Your Home Loan Interest Rate?2024-02-13 | 6 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Balance Transfer: Benefits, Eligibility, and More2024-05-15 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

Benefits of Submitting a Digital Home Loan Application in Current Times2023-12-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Common Mistakes to Avoid When Applying for a Home Loan2023-12-04 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Fixed and Floating Interest Rates2024-05-15 | 2 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

tax Tax

[N][T][T][N][T]

Top Benefits of Using an Online Income Tax Calculator2023-12-28 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

Know How Mortgage Loan Affect Your CIBIL Score2024-02-05 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

tax Tax

[N][T][T][N][T]

What Does It Mean to Have a CIBIL Score of -12023-06-16 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Terminologies2024-06-01 | 3 min

cibil Cibil

[N][T][T][N][T]

What Are Tradelines and How to Find Them On Your Credit Report?2024-05-28 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Ways to Check Bajaj Housing Loan Account Numbers2024-04-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2023-02-17 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What is the Process to Get Your Home Loan Approved Fast with Bajaj Housing Finance?2024-02-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance of an NOC Letter after Closing Your Home Loan2023-12-14 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Joint Home Loan with your Spouse2023-08-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenor that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How Digital Platforms Are Revolutionising the Face of Housing Finance2023-12-21 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Down Payment for a Home Loan?2024-05-16 | 5 min

tax Tax

[N][T][T][N][T]

Comparison Between New Tax Regime vs Old Tax Regime2024-04-10 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Know All About the Home Loan Foreclosure Procedure2023-12-20 | 5 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Advantages of Including a Co-Applicant on Your Home Loan2024-01-21 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What is the Difference Between Top-up Loan and Home Improvement Loan2023-01-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Are Registration Charges Compulsory When You Opt for a Home Loan?2024-04-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Can I Take a Home Loan and a Personal Loan Together?2024-01-17 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2023-01-30 | 3 min