The Home Loan rate of interest is crucial in determining the affordability of any loan. It is even more crucial in the case of a big-ticket and long-term loan, such as a Home Loan. Since Home Loans carry on for 20 to 30 years, even a minor difference in the Home Loan interest rates can help a Home Loan borrower save a lot of money in the long run. Low Home Loan interest rates help make Home Loan EMIs affordable and also help reduce the total cost of borrowing on the loan. A high-interest rate, on the other hand, may push one's EMIs into the unaffordable range and make the loan expensive and difficult to repay. Borrowers must, therefore, try their best to get the lowest interest rate possible when availing of a loan. This is possible only if the borrower has a clear understanding of the factors that affect Home Loan interest rates. So, let us look at Home Loan factors to consider when availing of a loan.

Loan-to-Value Ratio

Loan-to-Value ratio or LTV refers to the percentage of a property's market value that can be sanctioned as a loan. As an example, if your property is worth Rs.2 Crore and you avail of Rs.1.4 Crore as a loan, your LTV ratio would be 70%.

The LTV ratio is important as it determines the risk involved for the lender in lending money. High LTV ratio Home Loans carry a higher risk for lenders and therefore, lenders charge a high rate of interest on these loans. Low LTV ratio loans, on the other hand, are low-risk loans and therefore, lenders sanction these loans at a low rate of interest. Lenders sanction up to 90% of a property's value as a Home Loan. However, if you want to keep your Home Loan interest rates on the lower side, opt for a low LTV ratio loan. This does not mean pushing yourself to pay a higher down payment even if you cannot afford to. This simply means keeping the LTV ratio as low as comfortably possible.

Credit Score

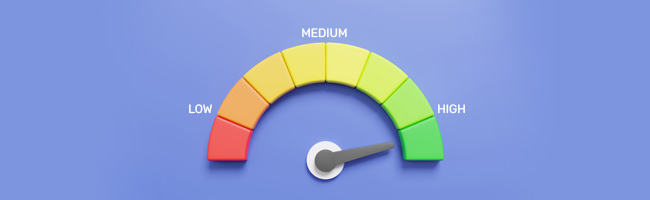

Once you apply for a Home Loan, the first thing that your lender will do after receiving your loan application is check your credit score. The credit score, also known as the CIBIL score, is a three-digit number between 300 and 900 that indicates a borrower's creditworthiness and ability to repay a loan on time. Borrowers who have a high credit score rarely default on loan payments and clear loan EMIs as per the amortization schedule. Borrowers with a low CIBIL score, on the other hand, are quite likely to default on loan payments. Lenders sanction the lowest Home Loan interest rates to borrowers who have a high CIBIL score. Anything between 750 and 900 is considered a good CIBIL score by lenders. If you are planning to apply for a Home Loan, check your credit score online before beginning the application process. Apply only if your credit score is 750 or above.

Also Read: Know What CIBIL Score is Considered Good for a Home Loan

Income and Job Stability

When it comes to the Home Loan rate of interest, it all comes down to how likely it is that the borrower will repay the loan on time. Borrowers with a stable job and stable income are more likely to pay Home Loan EMIs on time as compared to someone who switches jobs often or does not have a fixed or permanent source of income. Therefore, while sanctioning Home Loans, lenders prefer borrowers who have a stable job or a profitable business, are employed with a reputed MNC or a government company and have a stable source of income. The age of the borrower matters too. Borrowers who are in their prime receive lower interest rates as such borrowers are more likely to receive promotions and income hikes and therefore, are also more likely to repay the loan on time.

Quality of the Property

Home Loans are secured loans. These loans are secured by collateral, which is the home bought with the loan money. In case of loan default, the lender can sell the pledged collateral to recover the loan money. This is why the quality of the collateral matters when it comes to Home Loans. Properties located in a central location and having all modern amenities draw a lower rate of interest than a property located on the outskirts of an old property that will require a lot of repair work. If you are applying for a loan, know that the lender will look at the quality of the property while deciding the loan interest rates to be offered to you.

Repo Rate and the Interest Rate Regime You Have Chosen

Home Loans are offered at two types of interest rates. When borrowers opt for fixed interest rates, the rate of interest remains the same through the tenor of the loan. When borrowers opt for floating interest rates Home Loan, the rate of interest varies based on external market conditions. External market conditions govern the Repo Rate. When the inflation within the economy increases and the growth of the economy enters the slump phase, the RBI increases the Repo Rate, which is the rate at which the RBI lends money to commercial lenders within the company. When the Repo Rate goes up, the Home Loan interest rates go up too. On the other hand, when the Repo Rate goes down, Home Loans become cheaper.

Lenders charge a higher rate of interest on floating interest rate Home Loans or floating interest rate Home Loans are more expensive than fixed interest rate loans as the risk involved for the lender is higher in the case of floating interest rate loans.

Final Words

Borrowers must try their best to avail of a Housing Loan at the lowest interest rates possible. Doing so makes loan EMIs affordable and loan repayment easy. One of the best ways to get yourself the lowest interest rate is to do thorough market research and be well-informed about what each lender is offering. Doing this will allow you to be well informed about the interest rates that you may be able to get, and this will also increase your overall negotiating power with lenders.

People Also Read: Important Factors that Affect Your Home Loan Interest Rate

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Content with tag .

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Home Loan and Personal Loan: Which is better?2024-03-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

All About Home Loan Balance Transfers2024-06-04 | 4 mins

home+loan Home Loan

[N][T][T][N][T]

What Is Home Loan Eligibility and How Is It Calculated2024-07-11 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Top-up Loans on a Home Loan2024-04-09 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Better Interest Rate on Your Home Loan2024-01-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Get a Home Loan Without Visiting Branch: A Step-by-Step Guide2024-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Complete Guide to Securing a Attractive Interest on Home Loans2024-01-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Refinancing: What, Why, and Things to Remember2024-06-17 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

5 Great Ways Women Can Benefit from Taking a Housing Loan2024-01-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Types of Home Loan Charges2024-01-22 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

What is Foreclosing a Home Loan? These are Some of the Do’s and Don’ts2023-12-20 | 6 min

home+loan Home Loan

[N][T][T][N][T]

All You Need to Know About Home Loans2023-01-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Housing Loan Approved Instantly?2024-04-10 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What Is a Pre-Approved Home Loan and How Should You Get It Done?2024-03-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Pay Off Your Home Loan Quicker2024-03-11 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Consider These Factors Before Foreclosing Your Home Loan2024-04-16 | 3 min

home+loan Home Loan

[N][T][T][N][T]

6 Ways to Reduce Your Home Loan Interest2024-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What Affects the Interest Rate on Your Home Loan2024-03-13 | 5 min

home+loan Home Loan

[N][T][T][N][T]

10 Smart Steps for Effective Home Loan Management2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Advantages for First-Time Home Buyers2023-07-14 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Determine Your Ideal Credit Score for a Home Loan?2024-03-28 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Would it be Possible for Me to Apply for a Second Mortgage?2024-05-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Common Myths About Home Loans: All You Need to Know2024-04-08 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is an NOC Letter and Why is it Important?2024-05-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

5 Tips for Lowering Home Loan Interest Rates in 20232024-03-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How Can Your Credit Score Impact Your Home Loan Interest Rate?2024-02-13 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Balance Transfer: Benefits, Eligibility, and More2024-05-15 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

Benefits of Submitting a Digital Home Loan Application in Current Times2023-12-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Common Mistakes to Avoid When Applying for a Home Loan2023-12-04 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Fixed and Floating Interest Rates2024-05-15 | 2 min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Terminologies2024-06-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Ways to Check Bajaj Housing Loan Account Numbers2024-04-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What Do You Need to Know About Home Loan Foreclosure?2023-03-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Section 80EE: Claim Deductions on the Home Loan Interest Paid2023-02-17 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What is the Process to Get Your Home Loan Approved Fast with Bajaj Housing Finance?2024-02-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Top 5 Home Loan Benefits for First-time Woman Buyers2024-05-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance of an NOC Letter after Closing Your Home Loan2023-12-14 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Joint Home Loan with your Spouse2023-08-04 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenor that Suits Your Budget2023-06-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How Digital Platforms Are Revolutionising the Face of Housing Finance2023-12-21 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What is the Ideal Down Payment for a Home Loan?2024-05-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Know All About the Home Loan Foreclosure Procedure2023-12-20 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Advantages of Including a Co-Applicant on Your Home Loan2024-01-21 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What is the Difference Between Top-up Loan and Home Improvement Loan2023-01-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Are Registration Charges Compulsory When You Opt for a Home Loan?2024-04-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Can I Take a Home Loan and a Personal Loan Together?2024-01-17 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Should You Take a Home Loan Even If You Have Enough Money to Buy a House?2023-01-30 | 3 min

home+loan Home Loan

[N][T][T][N][T]

7 Common Problems You May Face While Applying For Home Loan2024-01-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

What Happens If Home Loan EMI Bounces? Know the Consequences2023-07-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Hybrid Flexi Loan vs. Personal Loan: Which One is Better?2024-01-24 | 3 min

home+loan Home Loan

[N][T][T][N][T]

An Essential Guide to Refinancing a Home Loan2024-04-22 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

10 Factors That Affect Your Home Loan Eligibility2024-05-21 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Property Registration Charges2024-03-13 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Should I Apply for a Pre-Approved Home Loan or an After Property Finalisation Loan?2024-03-15 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Connect with Bajaj Housing Customer Care2023-06-27 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

How to Access Your Login Details in Bajaj Customer Portal?2024-02-02 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Burden Management: Five Tips2022-06-27 | 3 min

home+loan Home Loan

[N][T][T][N][T]

A Complete Guide on the Benefits of Joint Home Loan2022-11-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Calculate Home Loan EMIs2022-06-14 | 5 Mins

home+loan Home Loan

[N][T][T][N][T]

Making Financial Planning Easy with a Home Loan EMI Calculator2023-09-06 | 2 min

home+loan Home Loan

[N][T][T][N][T]

All You Should Know About Home Loan Disbursement and Sanctioning Process2024-03-19 | 3 Min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Co-owner, Co-borrower, Co-Applicant, and Co-Signer in Home Loan2023-08-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How Do You Overcome Home Loan Repayment Burden?2023-02-13 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Best Credit Score for Home Loans & How to Improve Yours2023-08-31 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan vs Loan Against Property: A Complete Comparison2023-11-29 | 4 min

home+loan Home Loan

[N][T][T][N][T]

A Complete Guide for Home Loan Insurance2023-04-03 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What Are the Pros and Cons of Home Loan Balance Transfer?2023-02-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Check Your Bajaj Housing Finance Home Loan Status2022-06-22 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Benefits of a Home Loan2023-02-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Is It Mandatory to Take Insurance with a Home Loan?2023-08-01 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Secured vs Unsecured Loan - Know the Difference2023-08-24 | 2 min

home+loan Home Loan

[N][T][T][N][T]

How to Choose the Best Home Loan?2023-08-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Difference Between Bank Rate and Repo Rate2023-09-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Increase or Decrease Effects of Repo Rate2023-08-29 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the Benefits of a Home Loan EMI Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Avoid Rejection of Your Home Loan Application2023-08-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Check Housing Loan Eligibility with Home Loan Eligibility Calculator2023-07-12 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Tips to Get Home Loan with Minimum Down Payment in India2023-07-11 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Factors That Determine Your Home Loan Eligibility2023-07-24 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Differences Between Repo Rate and Monetary Policy Tools2023-07-28 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What Happens to a Home Loan in the Case of the Borrower's Death?2023-04-17 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Taking a Home Loan to Buy a Property for Investment? Here Are 5 Points to Consider2023-04-17 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Know All About the HRA Benefit on Payment of House Rent2023-04-03 | 6 min

home+loan Home Loan

[N][T][T][N][T]

A Guide to Statutory Liquidity Ratio2023-02-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Get Your Down Payment Funds Ready with These 5 Easy Steps2023-03-20 | 5 min

home+loan Home Loan

[N][T][T][N][T]

5 Strategies to Manage High Home Loan EMIs Effectively2023-02-22 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Why Is Credit Score Important for Home Loan Lenders?2023-03-21 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Importance Of a Good Credit Score in The Home Loan Process2023-03-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan EMI Calculator Benefits and It’s Features2023-02-21 | 4 min

home+loan Home Loan

[N][T][T][N][T]

4 Key Benefits of Home Loan Balance Transfer to Bajaj Housing Finance Limited2023-01-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Five Important Factors to Keep in Mind When Prepaying Your Home Loan2023-01-17 | 6 min

home+loan Home Loan

[N][T][T][N][T]

A Step-by-Step Guide to Home Loan Balance Transfer Application2022-12-20 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Factors to Consider Before Opting for Home Loan Balance Transfer2022-12-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Top Things to Keep Track of While Doing a Home Loan Balance Transfer2022-12-18 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Smart Things to Consider Before You Apply for a Home Loan2022-12-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Factors to Consider Before Applying for a Home Construction Loan2022-12-02 | 5 min

home+loan Home Loan

[N][T][T][N][T]

6 Point Differentiation Between Home Loan Vs Home Construction Loan2023-02-15 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Which is the Best Option: Land Purchase Loan or Home Loan?2023-02-01 | 6 min

home+loan Home Loan

[N][T][T][N][T]

10 Reasons Why a Housing Loan Application May Be Rejected2023-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Why Should You Choose a Balance Transfer on Your Home Loan?2023-02-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

The Importance of a Home Loan NOC2023-01-31 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Five Tips to Choose the Right Digital Platform for Home Loans2023-02-09 | 3 min

home+loan Home Loan

[N][T][T]Types[S]of[S]Home[S]Loans[S]Available[S]in[S]India[N][T]

Types of Home Loans Available in India2022-06-28 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

How to Pick the Best Home Loan Tenor that Suits Your Budget