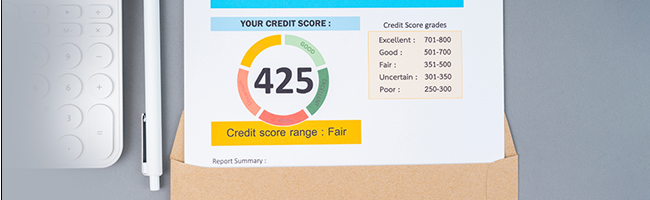

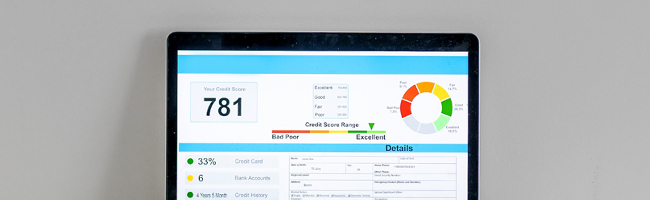

One of the things that lenders check about borrowers before assigning them a loan is their credit score or CIBIL score. The CIBIL score is a three-digit number that indicates a borrower’s creditworthiness and repayment capacity. An individual’s credit score ranges between 300 and 900; the closer a person’s CIBIL score is to 900, the better their chances of loan approval and availing of a loan on better terms and conditions. Credit information bureaus in India assign credit scores to individuals based on their credit reports. So, what is an ECN in CIBIL? Read on to know more.

What is an ECN in a CIBIL Report?

Before we continue, let us define ECN. ECN stands for Enquiry Control Number. The ECN is a nine-digit number that helps lenders and credit information bureaus identify a borrower’s credit profile. In other words, it is with the help of the ECN that all financial institutions that are a part of the CIBIL network can access a borrower’s credit profile and assess it to understand their attitude towards credit.

How to Get an ECN Number in CIBIL?

Here are the different ways in which a borrower can get their Enquiry Control Number in CIBIL:

- Firstly, if you want your ECN number, you can request CIBIL to share with you your ECN number. However, keep in mind that to be able to do so, you will have to buy a subscription plan under which CIBIL will send you your credit report. You will find your control number in the right-hand corner of your CIBIL report.

- Secondly, a borrower can also access their ECN number by calling CIBIL’s customer care number and requesting their credit report. If you opt for this method, you will be required to pay a fee.

Can Two Borrowers Have the Same ECN Number?

The answer is no. When a lender enquires about a borrower, an Enquiry Control Number is generated. Every enquiry generates a different ECN number and therefore, two borrowers cannot have the same ECN number.

Why is the ECN Important for Your Credit Report?

- Lenders sanction loans and grant credit only when they are convinced of a borrower’s repayment capacity and creditworthiness and to check a borrower’s repayment capacity, the first thing that lenders check is their credit report and CIBIL score. Lenders sanction loans to borrowers who have a clean repayment history. Borrowers with a CIBIL score of 750 or above stand a better chance to avail of better loan terms. The ECN helps lenders identify a borrower’s credit profile, which helps them decide whether to extend the concerned borrower a loan or not. Thus, in a way, the ECN connects borrowers with lenders.

- The ECN is also important because it helps CIBIL maintain the credit records of millions of customers around the world in such a way that the credit information bureau can access any borrower’s credit report at any time without any confusion. Thus, the concept of ECN helps CIBIL keep things organised.

- Lastly, the ECN helps CIBIL store a borrower’s credit history and payment details in a secure manner.

Read More: Check Your CIBIL Score Free

How to Use the ECN Number for Dispute Resolution?

The ECN (Enquiry Control Number) is essential when raising disputes in your CIBIL report. If you find errors, such as incorrect personal details, outdated loan entries, or accounts that don’t belong to you, you must provide the ECN number while submitting the dispute.

Final Words

To summarise, an ECN or enquiry control number is a nine-digit number unique to a borrower or credit account. The number is important as it helps lenders assess a borrower’s credit report and use the information in the report to assess a borrower’s creditworthiness and repayment capacity. The ECN helps CIBIL store information on millions of credit users in a systematic and organised manner.

Frequently Asked Question

An ECN (Enquiry Control Number) is a nine-digit number that helps lenders and credit information bureaus uniquely identify a borrower’s credit profile. It is used to access and assess a borrower’s credit report for loan evaluation.

The ECN is generated by CIBIL when a lender makes an enquiry about a borrower’s credit history. It helps to track and manage the borrower’s credit profile.

The control number is generated by CIBIL each time a lender enquires about a borrower’s credit history. It is a unique identifier for each enquiry.

No, each enquiry generates a different ECN, and therefore, two borrowers cannot have the same ECN.

The ECN is a nine-digit number that uniquely identifies a borrower’s credit profile.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?2023-06-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Detailed Overview of ‘A Khata’, ‘B Khata’ Certificates: Meaning, Differences, & Conversion Process2025-02-17 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL MSME Rank Explained – Why It Matters for Your Loan Against Property Application2025-07-07 | 5 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2024-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the ECN Number in Your CIBIL Report2025-07-08 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02024-06-20 | 3 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002024-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Get Commercial CIBIL Report – A Guide for LAP Applicants2025-07-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How a ‘Settled’ Status Can Affect Your CIBIL Score and Your Home Loan Chances2025-07-03 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score Rules – What Every Home‐Loan Applicant Should Know2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Improve Your CIBIL Score for a Home Loan in India?2025-09-19 | 3 min

[N][T][T][N][T]

How to Download Your CIBIL Report Online for Free?2025-11-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Exploring the Impact of Credit Applications on Your CIBIL Score2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

[N][T][T][N][T]

DLC Rate Rajasthan – What You Need to Know2025-09-29 | 4 min

[N][T][T][N][T]

Home Loan Eligibility for Informal Income Profiles2026-02-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

[N][T][T][N][T]

Sambhav Home Loan for Street Vendors and Hawkers2026-02-23 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

[N][T][T][N][T]

Sambhav Home Loans for Small Shop Owners2026-02-23 | 6 min

[N][T][T][N][T]

Sambhav Home Loans for Small Business Owners2026-02-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

[N][T][T][N][T]

How RERA Is Reshaping Trust in Affordable Housing?2026-02-20 | 3 min

[N][T][T][N][T]

Affordable Housing as a Structured Growth Driver2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Assam2025-11-12 | 3 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

tax Tax

[N][T][T][N][T]

How to Avail of Tax Benefits on a Loan Against Property2024-06-13 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

tax Tax

[N][T][T][N][T]

How to Claim Home Loan Tax Exemptions and HRA Together2023-03-22 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

tax Tax

[N][T][T][N][T]

Can I Claim Home Loan Tax Benefits on an Under-Construction Property?2024-05-23 | 5 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

tax Tax

[N][T][T][N][T]

8 Different Ways to Avail of Tax Benefits on Home Loans2023-03-03 | 4 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

[N][T][T][N][T]

PMC Property Tax: How to Pay Online2025-11-06 | 3 min

[N][T][T][N][T]

How to Calculate and Pay KMC Property Tax Online in Kolkata2025-11-06 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

[N][T][T][N][T]

Jantri Rate Gujarat – A Complete Guide to Land Valuation2025-09-30 | 4 min

[N][T][T][N][T]

How to Pay GHMC Property Tax Online ?2025-11-05 | 5 min

[N][T][T][N][T]

e-Rekha Kerala Land Records – Everything You Need to Know2025-10-09 | 5 min

[N][T][T][N][T]

BDA Property Tax in Bangalore – A Complete Guide2025-10-01 | 6 min

[N][T][T][N][T]

Safeguarding Your Credit Profile: Why It Matters2026-02-12 | 6 min

[N][T][T][N][T]

CRIF Score Explained: What It Means and Why It Exists2026-02-12 | 6 min

[N][T][T][N][T]

Checking Your CIBIL Score on Mobile: What It Looks Like