Sustained growth is essential for the success of any business. Businesses require capital to stay operational and implement ideas that drive expansion. Securing the necessary funds can be challenging for new companies still in the growth phase. One effective solution is leveraging business loans.

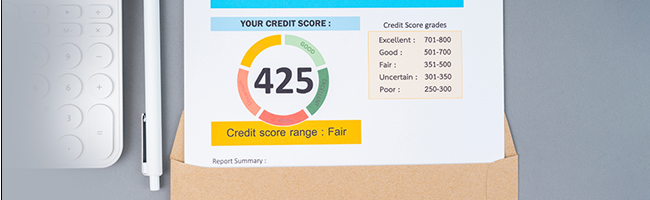

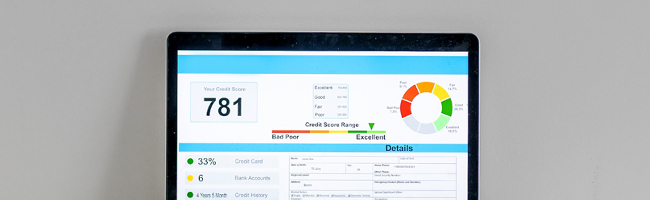

A business loan is a type of loan that a company can avail of to fulfil its professional needs and commitments such as business expansion. To be able to avail of these loans at competitive terms, it can be beneficial to have a high CIBIL score, typically above 750.

Business Credit Score vs. Personal Credit Score

Understanding the distinctions between personal and business credit scores is essential for both individual and corporate financial health. Here is a comparative overview:

| Personal Credit Score | Business Credit Score |

|---|---|

| Reflects an individual's creditworthiness based on personal financial history | Indicates a business's creditworthiness, assessing its financial health and reliability |

| Key factors that influence the score are payment history, credit utilisation, length of credit history, credit mix, and recent inquiries | Payment history, business age, types of credit used, and credit utilisation influence the score |

| Directly affects the ability to secure personal financing; a low score can lead to a higher interest rate | Influences business financing options, credit terms with suppliers, and overall business credibility |

Ways in Which a Business Loan Can Affect a Person’s CIBIL Score

Here are some situations where a business loan can affect your personal credit score:

1. Impact on Sole Proprietors:

-

If a business loan is taken in the sole proprietor's name, it directly affects their personal CIBIL score.

-

Timely repayment of EMIs as per the amortisation schedule improves the CIBIL score.

-

Missed EMIs or loan defaults can lower the CIBIL score.

2. Impact on Partnerships:

-

When business partners jointly take a business loan, repayment behaviour impacts the personal CIBIL scores of all partners.

-

Consistent and timely repayments are essential to maintaining good credit scores for all involved.

3. Impact on Limited Companies:

-

Business owners of limited companies maintain separate personal and company accounts.

-

Loans taken under the company’s name do not directly impact personal CIBIL scores. However, lenders may evaluate the business CIBIL score when business owners apply for other loans, such as personal loans or Loans Against Property.

Also Read: Easy Ways to Maintain a Good Business Credit Score

Now that we understand the concept of business loan CIBIL scores, let us look at what individual borrowers can do to increase CIBIL scores.

Working capital loans: These are loans that businesses can avail of to manage the shortfall in their cash during a specific season or month.

Start-up Loans: These loans can be availed of to cater to the needs of a start-up.

To be able to avail of these loans, it can be beneficial to have a high CIBIL score, which is typically between 750 and 900.

Simple Tips on How Business Owners Can Increase their CIBIL Score

Pay all Credit Card Bills and EMIs on Time

If you want to increase CIBIL score, the first thing that you must do is build the habit of paying all the credit card bills and EMIs on time. Your payment history is the factor that influences your credit score the most. So, make sure you have a clean payment history.

Do Not Exhaust Credit Cards

Business owners who want to avail of a business loan in their name and therefore, want to increase their CIBIL score should not exhaust the credit limit on their credit card as doing so can reduce their credit score. Ideally, borrowers should maintain a credit utilisation ratio of 30% or below.

Limit New Credit Applications

Whenever a borrower applies for a new loan, their chosen lender contacts a credit rating agency to get information on the applicant and how they handled credit in the past. Every time a lender enquires about an applicant, the query gets added to the applicant’s credit report and is known as a hard enquiry. Too many hard enquiries reduce the borrower's credit score.

Maintain a Healthy Credit Mix

Credit information agencies check a borrower’s ability to handle different types of credit before assigning them a loan. Thus, borrowers who have a balanced mix of secured and unsecured loans may have a higher CIBIL score.

Check Your Credit Report for Errors

Lastly, if you want to apply for a business loan, check your CIBIL score in advance by making an application or writing to any of the credit information agencies. You will have to pay CIBIL score charges to be able to avail of your credit report. Once the report is received, borrowers should check their credit reports for two things. First, on checking their CIBIL report, if they realize their credit rating is not as good as it should be for a loan and they need to increase their CIBIL score, they can take corrective measures in time. Second, while checking the report, if they find any errors that are negatively impacting their credit rating, they can report the errors and get them rectified.

Final Words

Setting up a business and making it grow may require quick access to funds. A business loan can help you avail of the funds you need. However, such a loan can prove helpful only if you meet the minimum CIBIL score for business loans set by your chosen lender. If you do not, use the tips mentioned in this article to increase your CIBIL score and then apply for a loan.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

FAQS

Yes, business loans can help build your credit score if they are repaid on time. For sole proprietors, timely repayment of business loans improves their personal CIBIL score. Similarly, for partnerships and private companies, timely repayment positively impacts the business credit score, which lenders consider when evaluating financial health.

Trending Articles

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Assam2025-11-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

IGR Maharashtra Property Registration Guide – Simplifying Your Property Transactions2025-10-22 | 3 min

home+loan Home Loan

[N][T][T][N][T]

IGRS Madhya Pradesh Guide to Property Registration – A Complete Overview2025-10-30 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration in Himachal Pradesh2025-10-09 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding Property Tax Assessment Number – A Guide for Homeowners2025-10-09 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Understanding MCF Property Tax – A Homeowner’s Guide to Paying Smartly in Faridabad2025-10-17 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Certified Copy of Your Property Title Deed: A Guide for Property Owners2025-07-16 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Download Your CIBIL Report Online for Free?2025-11-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL vs Experian – Which Credit Bureau is Better for Your Needs?2025-11-06 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

A Senior Citizen’s Guide to Reverse Mortgage: Meaning, Benefits and Key Insights2025-04-21 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What is STD, LSS & DPD in CIBIL Reports and Their Differences2025-11-07 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

PCMC Property Tax Portal: How to Pay Property Tax Online in PCMC2025-11-11 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL vs. Equifax vs. Experian vs. CRIF High Mark: Key Differences2025-11-10 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Property Registration in Bihar 2025: A Complete Guide to Charges, Process and Documents2025-11-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

LSS Meaning in CIBIL: What It Is and How It Affects a Credit Report2025-11-19 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

PMC Property Tax: How to Pay Online2025-11-06 | 3 min

home+loan Home Loan

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

home+loan Home Loan

[N][T][T][N][T]

Bihar Bhumi Land Records: Learn How to Access Land Records Online on Bihar Bhumi2025-02-27 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Calculate and Pay KMC Property Tax Online in Kolkata2025-11-06 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Building on Your Own Land – Understanding Home Loan for Plot Purchase and Construction2026-02-19 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

How to Pay Ahmedabad Municipal Corporation Property Tax Online?2025-11-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Jantri Rate Gujarat – A Complete Guide to Land Valuation2025-09-30 | 4 min

home+loan Home Loan

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan with No Credit History – A Structured Path to First-Time Homeownership2026-02-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Affordable Housing as a Structured Growth Driver2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How RERA Is Reshaping Trust in Affordable Housing?2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Government Housing Schemes and the Path towards ‘Housing for All’2026-02-20 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Sambhav Home Loans for Small Business Owners2026-02-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Sambhav Home Loans for Small Shop Owners2026-02-23 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan with Rs.25,000 Salary – Eligibility, Benefits, and Easy Approval2025-09-25 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Tax Benefits of Buying a House Property — How Owning a Property Can Lower Your Tax Obligation2025-09-26 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Minimum Annual Income for Home Loan – What You Need to Know2025-09-25 | 4 min

home+loan Home Loan

[N][T][T][N][T]

7 Ways to Manage Household Waste and Live Sustainably2025-09-26 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Decoding Bigha to Square Metre Conversion in India2025-09-26 | 3 min

home+loan Home Loan

[N][T][T][N][T]

DLC Rate Rajasthan – What You Need to Know2025-09-29 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Understanding NOC in Property Transactions2025-09-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Joint Home Loan with Three Applicants – Understanding Shared Home Ownership2025-09-25 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Maximising Tax Savings with Home Loans and Rent Payments2025-09-24 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Smart Ways to Increase Loan Borrowing Eligibility and Improve Home Loan Capacity2025-09-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How to Save for Your Dream Home in India?2025-09-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Eligibility for Two Home Loans in the Same Year2025-09-24 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Get a Home Loan for Your Dream Home in India?2025-09-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Can You Get a Home Loan Right After Starting a New Job?2025-09-23 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Can You Get a Home Loan Above Your Eligibility Limit in India?2025-09-22 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan-to-Value Ratio Explained: How Much Can You Really Borrow2025-09-05 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Sambhav Home Loan for Street Vendors and Hawkers2026-02-23 | 4 min

home+loan Home Loan

[N][T][T][N][T]

What Does it Mean to Pledge Your Property for a Home Loan?2025-09-01 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Difference Between Pledge vs. Hypothecation vs. Mortgage2025-09-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Manage Your Home Loan When Interest Rates Change2025-08-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What to Expect When You Sell a Property with an Active Home Loan2025-09-01 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Common Mistakes First-Time Homebuyers Should Avoid2025-08-12 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Salary Certificate for Home Loan – Your Complete Guide2025-08-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Eligibility for Informal Income Profiles2026-02-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Land Loan vs. Home Loan – Understanding the Key Differences2025-08-14 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Home Loan Pre-Closure2025-08-29 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Basics – A Friendly Guide for First-Time Buyers2025-08-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Plot Loan vs. Home Loan – Understanding the Difference2025-08-18 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Quick Home Loan Approval – A Practical Guide to Speeding Things Up2025-08-19 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Factors That Influence Top-up Loan Interest Rates2025-08-29 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Sambhav Home Loan for Self Employed Applicants – A Practical Guide for Small Business Owners2026-02-25 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Qualify for a Home Loan – A Complete Guide for First-Time Buyers2025-08-18 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for a Resale Property – Your Complete Guide2025-08-18 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Does Checking Your Credit Score Affect It?2026-01-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan for Small Business Owners – A Practical Guide for Self-Employed Applicants2026-02-25 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Generate a CIBIL Score for the First Time and Build a Strong Credit Foundation2026-01-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Without Credit Score – How to Apply Even with No Credit History2026-02-26 | 6 min

home+loan Home Loan

[N][T][T][N][T]

Co-Applicant in a Home Loan – Eligibility, Rules, and Documents Explained2026-02-26 | 5 min

home+loan Home Loan

[N][T][T][N][T]

DDA Housing Scheme Delhi – Everything You Need to Know About the Schemes2025-10-17 | 2 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Delhi Property Registration Guide: Understanding Registration, Charges and Circle Rates2025-11-12 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Impact of Home Loan Foreclosure on Credit Score – Should You Close Your Loan Early2025-07-24 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Assam Land Records: A Guide to Dharitree Portal, Land Patta Types, and Online Registration2025-02-17 | 4 min

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?2023-06-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Detailed Overview of ‘A Khata’, ‘B Khata’ Certificates: Meaning, Differences, & Conversion Process2025-02-17 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL MSME Rank Explained – Why It Matters for Your Loan Against Property Application2025-07-07 | 5 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2024-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the ECN Number in Your CIBIL Report2025-07-08 | 3 min

cibil Cibil

[N][T][T][N][T]

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02024-06-20 | 3 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002024-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Get Commercial CIBIL Report – A Guide for LAP Applicants2025-07-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How a ‘Settled’ Status Can Affect Your CIBIL Score and Your Home Loan Chances2025-07-03 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score Rules – What Every Home‐Loan Applicant Should Know2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Improve Your CIBIL Score for a Home Loan in India?2025-09-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Exploring the Impact of Credit Applications on Your CIBIL Score2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution