For most homebuyers, a Home Loan is a long-term financial commitment. Over time, the total interest paid on the loan can significantly affect your overall cost of borrowing. However, there are practical and effective strategies you can adopt to reduce your interest obligation. If you are wondering how to reduce your Home Loan interest rate, this guide offers actionable tips.

Tips to Reduce Your Interest Rate While Repaying the Home Loan

Managing your Home Loan effectively can lead to significant savings over time. By implementing strategic measures, you can reduce your interest outflow and make your loan repayment journey more manageable. Here are some practical tips to help you achieve this:

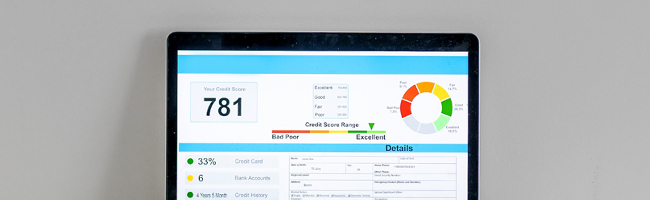

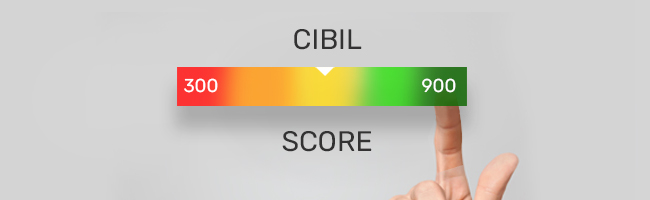

1. Maintain a High Credit Score

A strong credit score reflects your creditworthiness and can influence the interest rate offered by lenders. Aim for a credit score above 750 to increase your chances of securing a loan at a competitive rate. Regularly monitor your credit report and address any discrepancies promptly to maintain a healthy score.

2. Make Regular Prepayments

Utilising surplus funds, such as incentives and bonuses, to make prepayments on your Home Loan can significantly decrease the principal amount, leading to reduced interest charges. Even small, regular prepayments can have a substantial impact over time.

3. Consider a Home Loan Balance Transfer

Transferring your existing Home Loan to another lender offering a lower interest rate can be beneficial. This process, known as a Home Loan Balance Transfer, may result in reduced EMIs and overall interest savings. However, it is essential to evaluate associated costs such as processing fees and ensure that the transfer is beneficial.

4. Negotiate with Your Lender

If you have a good repayment history, consider negotiating with your current lender for a lower interest rate.

Will Home Loan Refinancing Help Reduce Interest Obligation?

Yes, refinancing your Home Loan—also known as a Home Loan Balance Transfer—can be an effective way to reduce your interest payout. Here is how it works:

- If you find a lender offering a lower interest rate than your current one, you can transfer the remaining loan balance to the new lender.

- The new lender may offer better terms such as reduced EMIs, a lower interest rate, or a flexible repayment option.

- Make sure to factor in processing charges and other associated costs to maximise savings.

It is advisable to consider refinancing in the early years of your loan when the interest component is highest, as it can lead to maximum savings over time.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

How to Get Commercial CIBIL Report – A Guide for LAP Applicants2025-07-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How a ‘Settled’ Status Can Affect Your CIBIL Score and Your Home Loan Chances2025-07-03 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score Rules – What Every Home‐Loan Applicant Should Know2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Improve Your CIBIL Score for a Home Loan in India?2025-09-19 | 3 min

[N][T][T][N][T]

How to Download Your CIBIL Report Online for Free?2025-11-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Exploring the Impact of Credit Applications on Your CIBIL Score2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

[N][T][T][N][T]

DLC Rate Rajasthan – What You Need to Know2025-09-29 | 4 min

[N][T][T][N][T]

Home Loan Eligibility for Informal Income Profiles2026-02-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

[N][T][T][N][T]

Sambhav Home Loan for Street Vendors and Hawkers2026-02-23 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

[N][T][T][N][T]

Sambhav Home Loans for Small Shop Owners2026-02-23 | 6 min

[N][T][T][N][T]

Sambhav Home Loans for Small Business Owners2026-02-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

[N][T][T][N][T]

How RERA Is Reshaping Trust in Affordable Housing?2026-02-20 | 3 min

[N][T][T][N][T]

Affordable Housing as a Structured Growth Driver2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Assam2025-11-12 | 3 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

tax Tax

[N][T][T][N][T]

How to Avail of Tax Benefits on a Loan Against Property2024-06-13 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

tax Tax

[N][T][T][N][T]

How to Claim Home Loan Tax Exemptions and HRA Together2023-03-22 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

tax Tax

[N][T][T][N][T]

Can I Claim Home Loan Tax Benefits on an Under-Construction Property?2024-05-23 | 5 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

tax Tax

[N][T][T][N][T]

8 Different Ways to Avail of Tax Benefits on Home Loans2023-03-03 | 4 min

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

[N][T][T][N][T]

PMC Property Tax: How to Pay Online2025-11-06 | 3 min

[N][T][T][N][T]

How to Calculate and Pay KMC Property Tax Online in Kolkata2025-11-06 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

[N][T][T][N][T]

Jantri Rate Gujarat – A Complete Guide to Land Valuation2025-09-30 | 4 min

[N][T][T][N][T]

How to Pay GHMC Property Tax Online ?2025-11-05 | 5 min

[N][T][T][N][T]

e-Rekha Kerala Land Records – Everything You Need to Know2025-10-09 | 5 min

[N][T][T][N][T]

BDA Property Tax in Bangalore – A Complete Guide2025-10-01 | 6 min

[N][T][T][N][T]

Safeguarding Your Credit Profile: Why It Matters2026-02-12 | 6 min

[N][T][T][N][T]

CRIF Score Explained: What It Means and Why It Exists2026-02-12 | 6 min

[N][T][T][N][T]

Checking Your CIBIL Score on Mobile: What It Looks Like2026-02-09 | 4 min

[N][T][T][N][T]

Uploading a Loan NOC in CIBIL2026-02-06 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Possession Certificate: Meaning, Importance, and Application Process2025-03-20 | 3 min

[N][T][T][N][T]

Relinquishment Deed: Meaning, Format, and Documents Required2025-03-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Mutation of Property: Meaning, Process, and Importance2025-03-20 | 5 min

[N][T][T][N][T]

AnyROR Gujarat and the e-Dhara Land Record Systems2025-02-26 | 3 min

[N][T][T][N][T]

What Is SMA in a CIBIL Report, and Why It Matters2026-01-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score for Home Loan – What Lenders Look For and How to Prepare2026-01-20 | 6 min

[N][T][T][N][T]

Building Your Credit Score When You Have No Credit History2026-01-21 | 3 min

[N][T][T][N][T]

Why Your Credit Score May Change Even When You Pay on Time2026-01-21 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Login and Registration – A Step-by-Step Guide to Getting Started2026-01-13 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

[N][T][T][N][T]

Understanding Gross Annual Value (GAV) – A Practical Guide2025-10-29 | 3 min

[N][T][T][N][T]

How to Pay Greater Chennai Corporation Property Tax Online2025-11-04 | 3 min

[N][T][T][N][T]

Vijayawada Municipal Corporation Property Tax Online2025-11-11 | 3 min

[N][T][T][N][T]

Understanding How Often Your CIBIL Score is Updated2025-11-07 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Partition Deed: A Comprehensive Guide to Its Meaning, Format, and Registration Process2025-04-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Check Land Records Online Using MP Bhulekh Portal2025-02-17 | 2 min

home+loan Home Loan

[N][T][T][N][T]

How to Convert Hectare to Bigha?2025-01-29 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Gift Deeds: A Comprehensive Guide to Registration and Documentation2025-01-29 | 2 min

[N][T][T][N][T]

How to Pay Lucknow Municipal Corporation Property Tax2025-11-07 | 4 min

cibil Cibil

[N][T][T][N][T]

How to Increase Your CIBIL Score Above 800: 7 Proven Methods