CIBIL presents credit information in different formats based on the type of borrower and the nature of credit exposure. This is why you may see a CIBIL score in some cases and a CIBIL rank in others. Both are designed to summarise credit information, but they apply to different borrower categories and are interpreted differently.

What is a CIBIL Score?

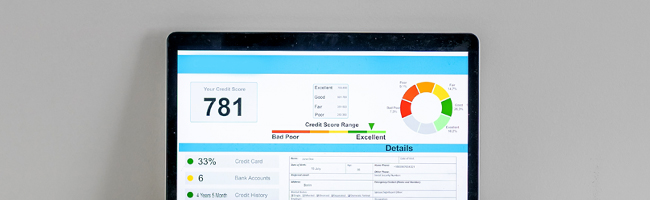

A CIBIL score is a three-digit number, usually ranging from 300 to 900, assigned to individual borrowers. It is generated based on credit accounts held by a person, such as credit cards, personal loans, Home Loans, or other retail credit products.

The score summarises repayment patterns, credit usage, account history, and recent activity into a single numerical indicator. It updates as lenders submit fresh information to CIBIL.

What is a CIBIL Rank?

A CIBIL rank applies to commercial entities rather than individuals. It is typically used for companies, partnerships, or businesses that borrow in a non-individual capacity.

Instead of a score, eligible businesses receive a rank on a scale that usually runs from 1 to 10. These ranking places the business within a relative band, based on its credit behaviour compared to other similar entities in the same segment.

In simple terms, a score is individual-focused, while a rank is business-focused.

Key Differences Between CIBIL Score and CIBIL Rank

The most fundamental difference lies in who they apply to.

A CIBIL score reflects individual credit behaviour and is expressed as a number, while a CIBIL rank reflects business credit behaviour and is expressed as a relative position. Scores evaluate absolute patterns over time; ranks compare performance within a defined group.

Another difference is eligibility. Not all businesses receive a CIBIL rank. It is generated only when sufficient commercial credit data is available.

How CIBIL Score is Calculated?

CIBIL scores are calculated by analysing multiple factors together.

These include repayment history, credit utilisation, length of credit history, mix of credit products, and recent credit enquiries. Each factor contributes to the overall score, with repayment behaviour carrying significant weight over time.

The score adjusts as these elements evolve.

How CIBIL Rank is Determined?

CIBIL rank is determined by evaluating a business’s credit exposure, repayment patterns, and overall credit conduct, and then placing it within a peer group.

Instead of focusing on a numerical score range, rank reflects relative positioning. This makes it easier for lenders to compare businesses of similar size or borrowing profile.

Why Both CIBIL Score and Rank Matter?

Score and rank serve different decision frameworks.

For individuals, the score helps lenders assess credit behaviour quickly. For businesses, rank offers comparative insight within a segment. Neither replaces the other, because they are not meant to be interchangeable.

Each exists to support a specific type of credit assessment.

How Lenders Use Score vs Rank in Decision-Making?

When evaluating individual borrowers, lenders typically rely on the CIBIL score alongside income and eligibility checks.

For businesses, lenders look at CIBIL rank along with financial statements, cash flows, and operational stability. The rank offers context rather than a standalone decision trigger.

Can Your CIBIL Rank Change Without Your Score Changing?

Yes, because they operate independently.

An individual’s CIBIL score can change based on personal credit activity, while a business’s CIBIL rank can shift if comparative positioning changes within its peer group, even when its own behaviour remains steady.

This is why score movement and rank movement should always be interpreted within their own frameworks.

Tips to Improve Your CIBIL Score and Rank

Improvement follows similar principles, even though the metrics differ.

Consistent repayments, balanced credit usage, measured borrowing, and allowing credit accounts to mature gradually support both individual scores and business ranks over time.

Regularly reviewing credit reports also helps ensure information is accurate and up to date.

FAQs

They are not comparable. Each applies to a different borrower category.

No. Individuals are assigned a CIBIL score, not a rank.

Only businesses with sufficient reported credit data receive a rank.

Lenders view the metric relevant to the borrower type they are assessing.

DISCLAIMER:

While care is taken to update the information, products, and services included in or available on our website and related platforms/websites, there may be inadvertent errors or delays in updating the information. The material contained in this website and on associated web pages, is for reference and general information purposes, and the details mentioned in the respective product/service document shall prevail in case of any inconsistency. Users should seek professional advice before acting on the basis of the information contained herein. Please take an informed decision with respect to any product or service after going through the relevant product/service document and applicable terms and conditions. Neither Bajaj Housing Finance Limited nor any of its agents/associates/affiliates shall be liable for any act or omission of the Users relying on the information contained on this website and on associated web pages. In case any inconsistencies are observed, please click on contact information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Possession Certificate: Meaning, Importance, and Application Process2025-03-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Mutation of Property: Meaning, Process, and Importance2025-03-20 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score for Home Loan – What Lenders Look For and How to Prepare2026-01-20 | 6 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Login and Registration – A Step-by-Step Guide to Getting Started2026-01-13 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Partition Deed: A Comprehensive Guide to Its Meaning, Format, and Registration Process2025-04-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Check Land Records Online Using MP Bhulekh Portal