A credit profile rarely asks for attention. It sits in the background, updating quietly as payments are made, limits are used, and accounts age. Most people do not think about it daily—and that is precisely why safeguarding it matters. Credit health is shaped as much by what you prevent as by what you actively do.

Protecting your credit profile is about awareness, timely checks, and a few disciplined habits that reduce the chances of unpleasant surprises later.

What is a Credit Profile

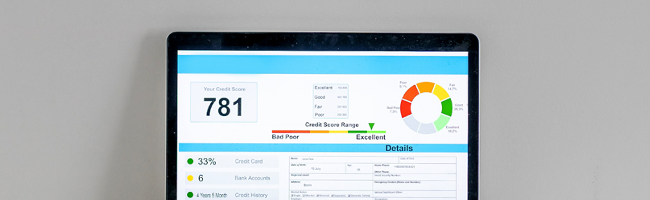

A credit profile is a consolidated record of your credit-related activity. It includes loan and credit card accounts, repayment patterns, outstanding balances, and recent credit enquiries, all reported by lenders to credit bureaus such as CIBIL.

Unlike a credit score, which is a single number, the profile is the underlying narrative. Scores change, but the profile is what drives those changes.

Why Safeguarding Your Credit Profile Matters

Safeguarding your credit profile helps ensure that this record reflects your actual behaviour. Errors or delayed updates can distort the picture lenders see.

Read Also: Maintain a Positive Credit Profile

Common Threats to Your Credit Profile

They can come up in the form of unnoticed data errors, delayed account closures, or misuse of personal information.

Occasionally, multiple small issues combine—an outdated address here, an unfamiliar enquiry there—and over time, they begin to affect credit perception.

How Identity Theft Affects Your Credit

Identity theft can introduce credit activity that does not belong to you. New accounts, unexpected enquiries, or unexplained dues may appear on your report.

The impact is often indirect. The issue is not just the fraud itself, but how long it goes undetected.

Read Also: Avoid Identity Theft and Credit Fraud

Steps to Protect Your Credit Information

Protection begins with basic caution. Sharing personal details sparingly, securing documents, and being attentive to consent requests go a long way.

It also helps to review statements and reports periodically, even when everything seems in order. Quiet checks are often more effective than reactive fixes.

How to Monitor Your Credit Profile Regularly

Regular monitoring does not mean daily tracking. Checking your credit report at intervals—such as before applying for credit or after closing an account—helps ensure accuracy.

Many borrowers prefer to align these checks with financial milestones, rather than treating them as routine alerts.

Also Read: Guide to Understand Your Credit Report

What to Do If You Detect Fraud or Suspicious Activity

If something looks unfamiliar, the first step is verification. Review the report carefully and confirm whether the activity is genuinely unauthorised.

Raising a dispute through official credit bureau channels helps flag the issue and initiate correction. Timely action limits how far inaccuracies can travel.

Best Practices for Securing Your Credit Score

Maintaining a good credit score often comes down to consistency. Timely repayments, measured use of credit limits, and avoiding unnecessary applications all contribute.

Tools and Services to Help Safeguard Your Credit Profile

Credit bureaus offer access to credit reports and updates that help individuals stay informed. Some services provide alerts for changes or enquiries.

FAQs

No. Viewing your own credit report is treated as a soft enquiry.

Periodic reviews around major financial decisions are usually sufficient.

Over time, even minor inaccuracies can influence how credit behaviour is interpreted.

Disclaimer

These rates are indicative and remain subject to change depending on the laws and government guidelines, applicable at the time being. However, Bajaj Housing Finance Limited (‘BHFL’) is under no obligation to update or keep the information current. Users are advised to seek independent legal and professional advice before acting on the basis of the information contained in the Website. Placing reliance on the aforementioned information shall always be the sole responsibility and decision of the User and the User shall assume the entire risk of any use made of this information.

In no event shall BHFL or the Bajaj Group, its employees, directors or any of its agents or any other party involved in creating, producing, or delivering this Website shall be liable for any direct, indirect, punitive, incidental, special, consequential damages (including lost revenues or profits, loss of business or loss of data) or any damages whatsoever connected to the User’s reliance on the aforementioned information.

Trending Articles

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Possession Certificate: Meaning, Importance, and Application Process2025-03-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Mutation of Property: Meaning, Process, and Importance2025-03-20 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score for Home Loan – What Lenders Look For and How to Prepare2026-01-20 | 6 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Login and Registration – A Step-by-Step Guide to Getting Started2026-01-13 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

home+loan Home Loan

[N][T][T][N][T]

Partition Deed: A Comprehensive Guide to Its Meaning, Format, and Registration Process2025-04-01 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Check Land Records Online Using MP Bhulekh Portal