Trending Articles

cibil Cibil

[N][T][T][N][T]

How Can I Get My ECN Number in CIBIL?2024-01-09 | 5 min

[N][T][T][N][T]

A Complete Guide to Check Credit Score Easily for Free2024-05-02 | 3 min

cibil Cibil

[N][T][T][N][T]

Impact of Late Payment on CIBIL Score?2024-03-08 | 6 min

cibil Cibil

[N][T][T][N][T]

What Does a Zero or Negative Credit Score Mean?2023-02-24 | 4 min

cibil Cibil

[N][T][T][N][T]

How Can Customers Check Their Credit History?2023-06-14 | 3 min

cibil Cibil

[N][T][T][N][T]

How a Good CIBIL Score Can Help You Celebrate the Festive Season Better2024-03-19 | 5 min

cibil Cibil

[N][T][T][N][T]

What is Credit Score and Its Impact on Loan Availability2023-03-27 |

cibil Cibil

[N][T][T][N][T]

How Do You Establish a Credit Score for the First Time?2023-03-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What Is Credit Utilization Ratio and How Can You Improve It?2024-03-22 | 5 min

home+loan Home Loan

[N][T][T][N][T]

A Detailed Overview of ‘A Khata’, ‘B Khata’ Certificates: Meaning, Differences, & Conversion Process2025-02-17 | 2 min

cibil Cibil

[N][T][T][N][T]

Reasons Why Your CIBIL Score Is Going Down2024-04-10 | 4 min

cibil Cibil

[N][T][T][N][T]

Why is a CIBIL Score Measured Between 300 and 900?2024-05-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL MSME Rank Explained – Why It Matters for Your Loan Against Property Application2025-07-07 | 5 min

cibil Cibil

[N][T][T][N][T]

What Factors Do Not Affect Credit Scores?2024-02-28 | 7 min

cibil Cibil

[N][T][T][N][T]

How Many Credit Inquiries are Too Much in a Year2023-09-21 | 2 min

cibil Cibil

[N][T][T][N][T]

How Long Does It Take to Improve a CIBIL Score2023-03-29 | 5 min

cibil Cibil

[N][T][T][N][T]

How To Improve CIBIL Score After A Payment Default?2024-03-29 | 4 min

cibil Cibil

[N][T][T][N][T]

Why Is It Important to Check Your Credit Report and How Often?2023-03-22 | 3 min

cibil Cibil

[N][T][T][N][T]

Here Is How a Bounced Cheque Can Affect Your CIBIL Score2023-06-06 | 5 min

[N][T][T][N][T]

The CIBIL Score Advantage for Loan Approval2025-05-05 | 7 min

cibil Cibil

[N][T][T][N][T]

What is CIBIL? Understand How It Works and Its Importance2024-01-31 | 6 min

cibil Cibil

[N][T][T][N][T]

Minimum CIBIL Score for Business Loans2023-04-17 | 5 min

cibil Cibil

[N][T][T][N][T]

Boost Your Credit Score By Minding The Factors That Affect It2023-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Here’s How a Short-term Loan Can Help You Improve Your CIBIL Score2024-03-25 | 5 min

cibil Cibil

[N][T][T][N][T]

How Does Your Digital Footprint Affect Your CIBIL Score?2024-03-20 | 5 min

cibil Cibil

[N][T][T][N][T]

Pay Minimum Amount Due on Your Credit Cards Will Impact Your Credit Score2024-03-11 | 5 min

cibil Cibil

[N][T][T][N][T]

How can I Remove Loan Inquiry from CIBIL Credit Report2024-01-22 | 5 min

cibil Cibil

[N][T][T][N][T]

Introduction to Credit Information Bureau India Limited (CIBIL)2024-04-15 | 6 min

cibil Cibil

[N][T][T][N][T]

A Helpful Guide to Understanding Your Credit Report2024-01-26 | 5 min

cibil Cibil

[N][T][T][N][T]

Difference Between Credit Score and CIBIL Score2024-02-15 | 5 min

cibil Cibil

[N][T][T][N][T]

How Business Loans Affect Your CIBIL Score & How to Improve the Same2024-03-13 | 6 min

cibil Cibil

[N][T][T][N][T]

What are the Types CIBIL Errors & How to Correct Them?2023-11-22 | 6 min

cibil Cibil

[N][T][T][N][T]

What's Considered a Healthy Credit Mix?2024-06-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding the ECN Number in Your CIBIL Report2025-07-08 | 3 min

cibil Cibil

[N][T][T][N][T]

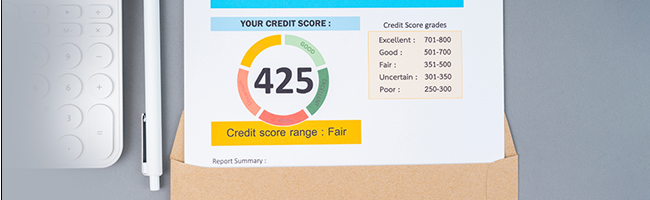

What Does Your Credit Score Tell About You?2024-06-11 | 5 min

cibil Cibil

[N][T][T][N][T]

What to Know About CIBIL Score 2.02024-06-20 | 3 min

cibil Cibil

[N][T][T][N][T]

Tips to Maintain Your Business CIBIL Score Above 7002024-02-02 | 5 min

cibil Cibil

[N][T][T][N][T]

Does a Name Change Affect Your Credit Score2024-01-07 | 4 min

home+loan Home Loan

[N][T][T][N][T]

How to Get Commercial CIBIL Report – A Guide for LAP Applicants2025-07-07 | 4 min

cibil Cibil

[N][T][T][N][T]

What Distinguishes CIBIL Score from CIBIL Report?2024-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Removing Credit Enquiries from CIBIL – What You Should Know2025-07-04 | 6 min

cibil Cibil

[N][T][T][N][T]

10 Common Myths About CIBIL Score2024-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

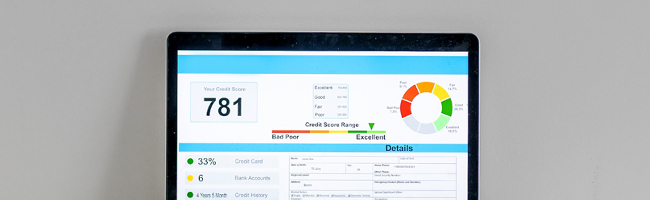

How to Check CIBIL Score Online?2023-03-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

How a ‘Settled’ Status Can Affect Your CIBIL Score and Your Home Loan Chances2025-07-03 | 6 min

cibil Cibil

[N][T][T][N][T]

What is the Procedure to Check your CIBIL Score Rating?2023-03-27 | 4 min

cibil Cibil

[N][T][T][N][T]

Here’s What These Various Sections of a CIBIL Report Mean2023-03-21 | 5 min

cibil Cibil

[N][T][T][N][T]

Everything You Should Know About Your CIBIL Score2024-02-09 | 7 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score Rules – What Every Home‐Loan Applicant Should Know2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check, Calculate, and Improve CIBIL Score?2024-01-11 | 2 min

cibil Cibil

[N][T][T][N][T]

Loan Rejection Impact on CIBIL Score2024-12-23 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Improve Your CIBIL Score for a Home Loan in India?2025-09-19 | 3 min

[N][T][T][N][T]

How to Download Your CIBIL Report Online for Free?2025-11-14 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Exploring the Impact of Credit Applications on Your CIBIL Score2025-07-08 | 5 min

cibil Cibil

[N][T][T][N][T]

Check CIBIL Score with PAN Card for Free, in 3 Steps2024-02-27 | 5 min

cibil Cibil

[N][T][T][N][T]

How to Check Your CIBIL Score for Free and What to Do If There Are Errors in It2024-06-05 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Residential Property: A Smart Financing Solution2025-03-10 | 3 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Mortgage Loan Against Vacant Land: A Feasible Way to Unlock Property Value2025-05-05 | 3 min

home+loan Home Loan

[N][T][T][N][T]

What are the Different Types of Loans Available in India?2024-01-02 | 5 Min

[N][T][T][N][T]

DLC Rate Rajasthan – What You Need to Know2025-09-29 | 4 min

[N][T][T][N][T]

Home Loan Eligibility for Informal Income Profiles2026-02-24 | 5 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Stamp Duty and Registration Charges in Tamil Nadu2025-05-08 | 6 min

home+loan Home Loan

[N][T][T][N][T]

How to Know the Survey Number of Land in India2025-04-01 | 2 min

[N][T][T][N][T]

Sambhav Home Loan for Street Vendors and Hawkers2026-02-23 | 4 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Gujarat2025-04-11 | 3 min

home+loan Home Loan

[N][T][T][N][T]

How to Claim a Stamp Duty Refund After Cancelling a Registered Sale Deed in Maharashtra2025-04-02 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Know About CTS Number When Buying a Property in Mumbai2025-03-04 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is MODT in Home Loans & Importance2025-01-27 | 5 min

[N][T][T][N][T]

Sambhav Home Loans for Small Shop Owners2026-02-23 | 6 min

[N][T][T][N][T]

Sambhav Home Loans for Small Business Owners2026-02-23 | 5 min

home+loan Home Loan

[N][T][T][N][T]

What is LOD in Home Loans? Meaning, Importance, and Benefits2025-01-10 | 2 min

home+loan Home Loan

[N][T][T][N][T]

Khasra Number Explained: How to Find It2025-01-03 | 2 min

[N][T][T][N][T]

How RERA Is Reshaping Trust in Affordable Housing?2026-02-20 | 3 min

[N][T][T][N][T]

Affordable Housing as a Structured Growth Driver2026-02-20 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Home Loan Pre-Closure: Is it the Right Step for You?2025-05-29 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty on Home Loan in India – What You Need to Know Before Buying a Property2025-09-12 | 4 min

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Assam2025-11-12 | 3 min

tax Tax

[N][T][T][N][T]

10 Useful Income Tax Deductions for FY 2022-232024-02-21 | 6 min

tax Tax

[N][T][T][N][T]

How to Avail of Tax Benefits on a Loan Against Property2024-06-13 | 5 Min

home+loan Home Loan

[N][T][T][N][T]

ITR Filing for Home Loan – Know the Right Process to File Your Income Tax Returns2024-02-16 | 5 min

tax Tax

[N][T][T][N][T]

How to Claim Home Loan Tax Exemptions and HRA Together2023-03-22 | 5 min

tax Tax

[N][T][T][N][T]

How Much Tax Can be Saved Under Sections 80C, 80D, and 80G?2024-05-15 | 5 min

[N][T][T][N][T]

Everything You Need to Know About Home Loan Tax Benefits2024-04-23 | 6 min

tax Tax

[N][T][T][N][T]

Can I Claim Home Loan Tax Benefits on an Under-Construction Property?2024-05-23 | 5 min

tax Tax

[N][T][T][N][T]

8 Useful Income Tax Exemptions for Salaried Employees2024-04-18 | 7 min

tax Tax

[N][T][T][N][T]

8 Different Ways to Avail of Tax Benefits on Home Loans2023-03-03 | 4 min

tax Tax

[N][T][T][N][T]

How to Avail Maximum Home Loan Tax Benefit in India in 2023?2024-05-13 | 6 min

tax Tax

[N][T][T][N][T]

Tax Benefits on Home Loans for Self-Employed Individuals: What You Need to Know2024-06-07 | 4 min

tax Tax

[N][T][T][N][T]

Top 5 Tax Benefits and Other Advantages of a Joint Home Loan2024-07-10 | 8 min

home+loan Home Loan

[N][T][T][N][T]

Stamp Duty and Property Registration Charges in Kerala: A Comprehensive Guide2025-04-11 | 2 min

[N][T][T][N][T]

PMC Property Tax: How to Pay Online2025-11-06 | 3 min

[N][T][T][N][T]

How to Calculate and Pay KMC Property Tax Online in Kolkata2025-11-06 | 5 min

loan+against+property Loan Against Property

[N][T][T][N][T]

Loan Against Agricultural Land: Unlock the Value of Your Property2025-03-07 | 6 min

[N][T][T][N][T]

Jantri Rate Gujarat – A Complete Guide to Land Valuation2025-09-30 | 4 min

[N][T][T][N][T]

How to Pay GHMC Property Tax Online ?2025-11-05 | 5 min

[N][T][T][N][T]

e-Rekha Kerala Land Records – Everything You Need to Know2025-10-09 | 5 min

[N][T][T][N][T]

BDA Property Tax in Bangalore – A Complete Guide2025-10-01 | 6 min

[N][T][T][N][T]

Safeguarding Your Credit Profile: Why It Matters2026-02-12 | 6 min

[N][T][T][N][T]

CRIF Score Explained: What It Means and Why It Exists2026-02-12 | 6 min

[N][T][T][N][T]

Checking Your CIBIL Score on Mobile: What It Looks Like2026-02-09 | 4 min

[N][T][T][N][T]

Uploading a Loan NOC in CIBIL2026-02-06 | 4 min

home+loan Home Loan

[N][T][T][N][T]

Possession Certificate: Meaning, Importance, and Application Process2025-03-20 | 3 min

[N][T][T][N][T]

Relinquishment Deed: Meaning, Format, and Documents Required2025-03-19 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Mutation of Property: Meaning, Process, and Importance2025-03-20 | 5 min

[N][T][T][N][T]

AnyROR Gujarat and the e-Dhara Land Record Systems2025-02-26 | 3 min

[N][T][T][N][T]

What Is SMA in a CIBIL Report, and Why It Matters2026-01-14 | 3 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Score for Home Loan – What Lenders Look For and How to Prepare2026-01-20 | 6 min

[N][T][T][N][T]

Building Your Credit Score When You Have No Credit History2026-01-21 | 3 min

[N][T][T][N][T]

Why Your Credit Score May Change Even When You Pay on Time2026-01-21 | 4 min

home+loan Home Loan

[N][T][T][N][T]

CIBIL Login and Registration – A Step-by-Step Guide to Getting Started2026-01-13 | 3 min

home+loan Home Loan

[N][T][T][N][T]

Understanding Loan-to-Value Ratio (LTV) and its Calculation2023-11-28 | 4 Min

[N][T][T][N][T]

Understanding Gross Annual Value (GAV) – A Practical Guide2025-10-29 | 3 min

[N][T][T][N][T]

How to Pay Greater Chennai Corporation Property Tax Online2025-11-04 | 3 min

[N][T][T][N][T]

Vijayawada Municipal Corporation Property Tax Online2025-11-11 | 3 min

[N][T][T][N][T]

Understanding How Often Your CIBIL Score is Updated